The Institute on Taxation and Economic Policy

What's New

The Child Tax Credit Leaves Out Millions of Children in 2026. There Are Better Alternatives.

March 10, 2026 • By Joe Hughes

The 2025 Trump tax law slightly increased the Child Tax Credit in a way that benefits virtually none of the children who most need help.

Governor Should Put New Mexico’s Tax Interests First

March 6, 2026 • By Amy Hanauer, Amber Wallin

By decoupling from three misguided federal corporate income tax cuts under the One Big Beautiful Bill, plus taking steps to curb unfair corporate tax avoidance, SB 151 would raise and safeguard more than $120 million annually.

State Rundown 3/4: Budget Realities Set In

March 4, 2026 • By ITEP Staff

As many state legislative sessions near or cross the halfway point, lawmakers are facing tough choices.

New Income Tax Disclosure Rules Mean Halliburton Can No Longer Conceal Its Offshore Tax Avoidance

March 2, 2026 • By Matthew Gardner

The company’s latest annual report throws the doors wide open once again on Halliburton’s penchant for offshoring its profits to tax havens, thanks to terrific new disclosure rules introduced by an obscure but vital agency, the Financial Accounting Standards Board (FASB).

Cheniere Energy Gets $380 Million Gift from Trump’s Treasury Department

February 26, 2026 • By Matthew Gardner

Cheniere Energy's latest annual financial report shows the company reaped a cool $380 million in tax cuts from a single regulatory change made by the Trump administration last fall.

ITEP in the News

Springfield News-Leader: Property Tax Caps on April Ballot in Several Counties Worry Districts

MarketPlace: Trump’s Tax Breaks for Big Corporations

Barron's: Trump Says His Tariffs Could Replace Income Taxes. Here’s What Tax Experts Say.

NPR: Tariffs Cost American Shoppers. They’re Unlikely To Get That Money Back

St. Louis Magazine: How St. Louis County's Senior Tax Freeze Takes from the Young to Give to the Old

ITEP Work in Action

Testimony: ITEP's Marco Guzman Outlines Positive Tax Reform Proposals for Colorado Lawmakers

Testimony: ITEP's Brakeyshia Samms on Why Evanston Should Adopt a Property Tax Circuit Breaker

Oregon Center for Public Policy: Tax Cuts for the Rich, Higher Taxes for Everyone Else: The Net Effect of Trump’s Tax Policies

California Budget & Policy Center: 5 Facts To Know About Corporate Taxes in California

ITEP Data Cited in New York Corporate Tax Bill

Across the States

Tax Watch

State Tax Watch 2026

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

Get weekly updates by signing up for our State Rundown newsletter.

Learn more about state taxes across the country, read Who Pays?

State Rundown & On the Map

On the Map

State Rundown 3/4: Budget Realities Set In

As many state legislative sessions near or cross the halfway point, lawmakers are facing tough choices.

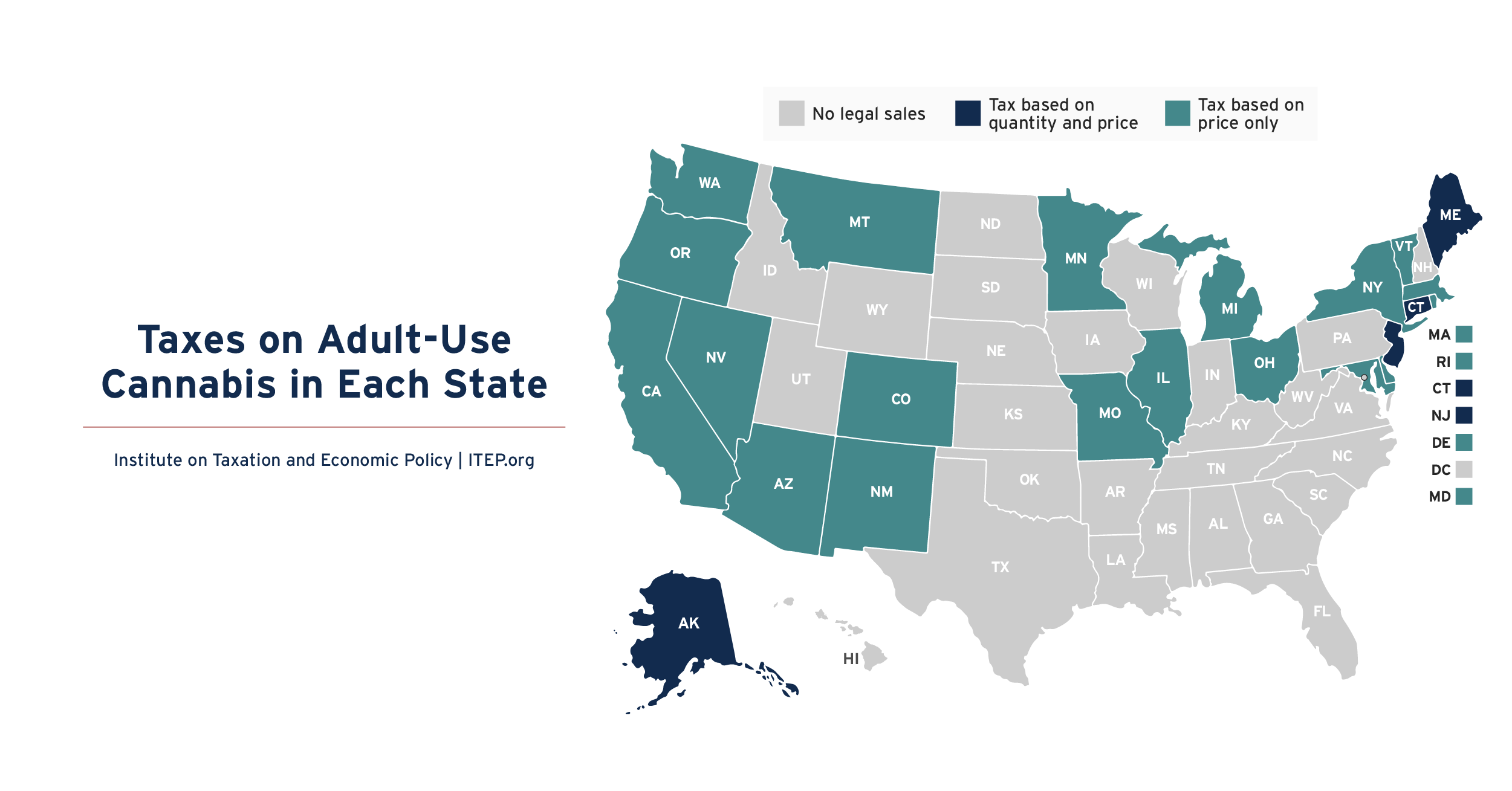

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

State & Local Tax Policy

State Tax Watch 2026

March 9, 2026 • By ITEP Staff

Governor Should Put New Mexico's Tax Interests First

March 6, 2026 • By Amber Wallin, Amy Hanauer

Pioneer Institute Criticizes ITEP For Not Writing the Paper They Would Have Written

February 25, 2026 • By Eli Byerly-Duke

Property Tax Reforms Can Bring Racial Justice

February 19, 2026 • By Brakeyshia Samms