The Institute on Taxation and Economic Policy

What's New

An Analysis of a Potential Reduction in Massachusetts’ Long-Term Capital Gains Tax Rate

January 26, 2026 • By Eli Byerly-Duke, Matthew Gardner

A ballot initiative in Massachusetts has proposed cutting the base rate for nearly all income sources from 5 to 4 percent. In 2026, this would cost the state about $5 billion per year of which $347 million would come from the reduced rate on long-term capital gains.

How the Wealthy Exploit the Tax Code: Q&A with Professor Ray Madoff, Author of ‘The Second Estate’

January 26, 2026 • By Brakeyshia Samms

Her timely book, The Second Estate: How the Tax Code Made an American Aristocracy, walks readers through federal tax policy history and the modern-day legal maneuvers the wealthy use to pay little to no taxes

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

They should take steps to protect and boost their own revenues. And they should take a second look at their own tax cuts.

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

2025 saw an intensification of state and local tax fights across the country, as well as growing experimentation with local-option taxes, levies, fees, and tourism taxes aimed at keeping budgets afloat while also navigating political constraints imposed by state legislatures.

ITEP in the News

Time: Americans Are Paying for Trump's Tariffs, Study Finds

Education Week: Schools Brace for Mid-Year Cuts as 'Big, Beautiful Bill' Changes Begin

MarketWatch: Tax the Rich in '26? These 3 Crucial Questions about Wealth Taxes Could Be Answered This Year

Associated Press: Georgia Republicans Move to Scrap State Income Tax by 2032 Despite Concerns

Newsweek: US Property Tax Changes Coming in 2026

ITEP Work in Action

Center on Budget and Policy Priorities: States Should Adopt the Wealth Proceeds Tax to Raise New Revenue

Georgia Budget & Policy Institute: Overview of Georgia’s Budget for Amended Fiscal Year 2026 and the Full 2027 Fiscal Year

North Carolina Department of Commerce: The Hidden Cost of Child Care Gaps in North Carolina's Economy

Joint Center for Political and Economic Studies: State of the Dream 2026: From Regression to Signs of a Black Recession

New Jersey Policy Perspective: Five Budget Time Bombs Facing the Next Governor

Across the States

On the Map

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to…

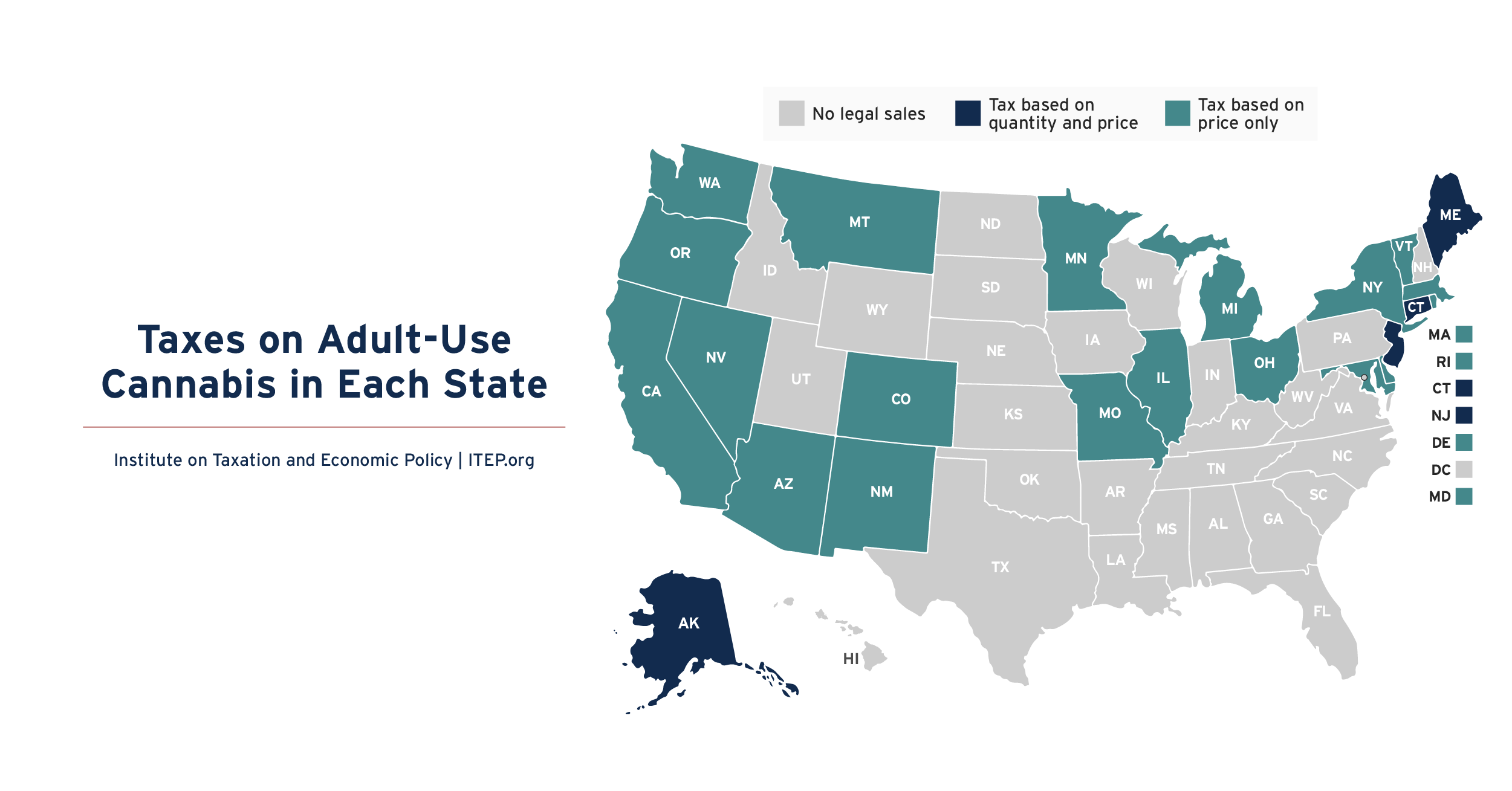

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

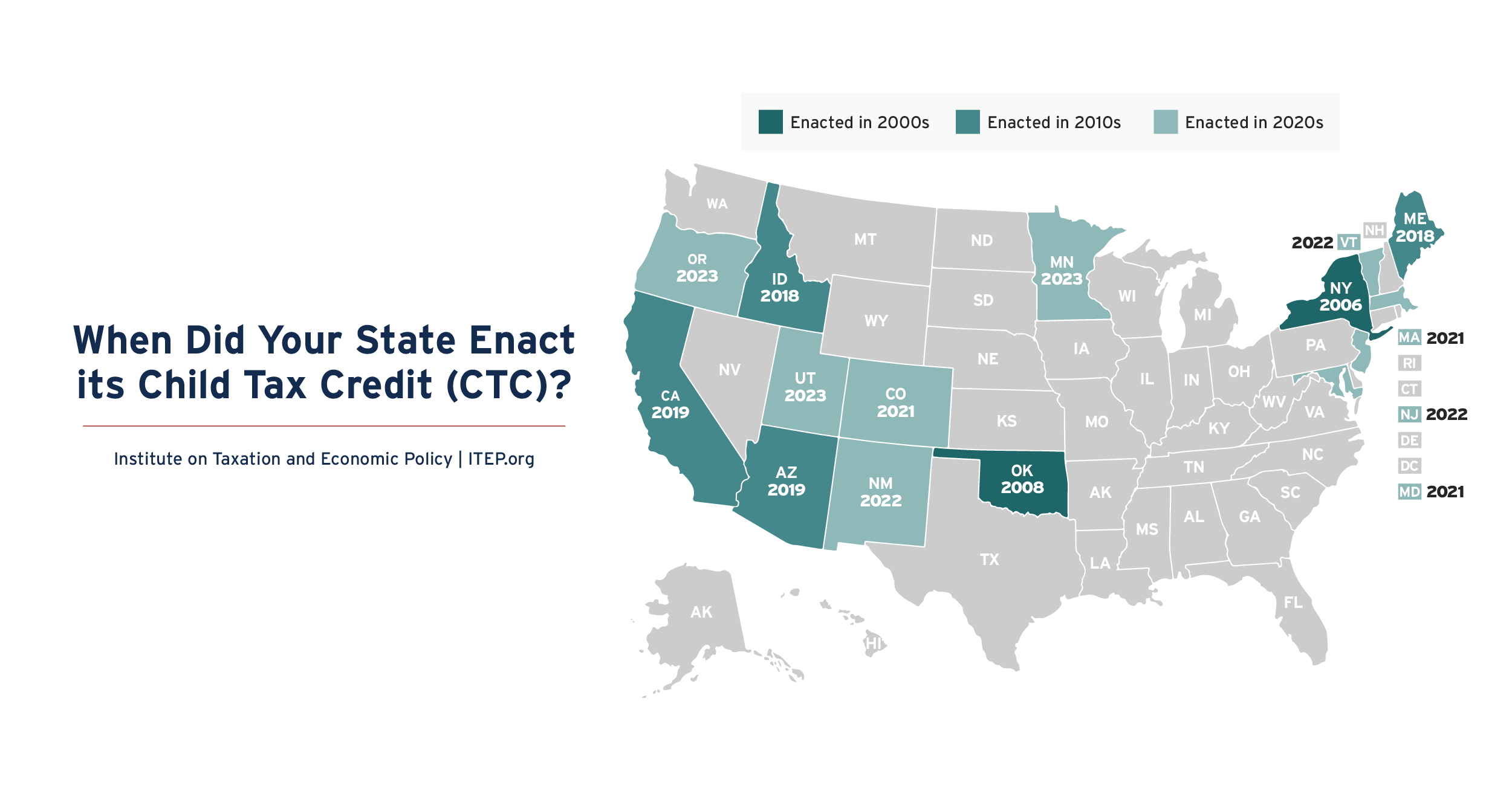

When Did Your State Enact a Child Tax Credit?

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also…

State & Local Tax Policy

An Analysis of a Potential Reduction in Massachusetts’ Long-Term Capital Gains Tax Rate

January 26, 2026 • By Eli Byerly-Duke, Matthew Gardner

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

Curbing Tax Deductions for Executive Pay is a Federal Tax Change States Should Get Behind

January 9, 2026 • By Matthew Gardner

Show Me Where We're Going: Missouri’s Fiscally Irresponsible Path Will Be Paid for by Everyday People

January 8, 2026 • By Logan Liguore

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

2025: The Year in Tax Policy

December 23, 2025 • By ITEP Staff

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

The ITEP Guide to State & Local Taxes

The ITEP Guide to State & Local Taxes offers citizens, advocates, journalists, and policymakers a detailed primer on state and local tax policy. Learn more about the three main sources of revenue (income, property, and sales) and the major principles that shape tax codes and discussions.

Tax Principles

Income & Profits

Property & Wealth

Sales & Use

Other Revenues