Recent Work

2069 items

Who Can Make a Billion Dollar Mistake and Not Lose Their Jobs? Congressional Tax Writers

September 5, 2025 • By Matthew Gardner

A drafting error in the 2017 tax law will cost U.S. taxpayers over $1 billion in unintended tax cuts for big multinationals.

State Rundown 9/4: Colorado Tackles Offshore Corporate Tax Avoidance, Paves Way for State Conformity Best Practices

September 4, 2025 • By ITEP Staff

Despite an increasingly bleak state revenue outlook, state lawmakers across the country continue to prioritize regressive tax cuts.

Colorado Lawmakers Help Fill Trump-Induced Shortfall by Tackling Offshore Corporate Tax Avoidance

August 26, 2025 • By Matthew Gardner, Marco Guzman

As the Trump megabill blows holes in state budgets, Colorado is leading with reforms to curb offshore tax avoidance and roll back wasteful corporate subsidies.

As federal data systems erode, the U.S. risks losing the impartial information needed for sound policymaking and public trust.

The Trump Megabill Hands the Rich a Gift — and Sends the Bill to Young Americans

August 21, 2025 • By Angie Sumo

Trump's megabill directs most benefits to the wealthy, while leaving younger generations with higher taxes, more debt, and fewer opportunities. For Millennials and Gen Z, it means reduced public investment and an economy less likely to work in their favor.

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By Matthew Gardner

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

State Rundown 8/20: States to Face Serious Conformity, Revenue Issues as Summer Ends

August 20, 2025 • By ITEP Staff

While tax news has slowed as summer comes to an end, there are rumblings beneath the surface that could be an inauspicious sign of the times ahead for states and state budgets.

Trump Administration’s English-Only IRS Would Undermine Public Trust and Boost Budget Deficits

August 19, 2025 • By Matthew Gardner

The Trump administration’s push to make English the official U.S. language threatens decades of progress in taxpayer services for non-English speakers, risking cuts to IRS multilingual support, harder tax filing, lower compliance, and an undermined agency mission.

Trump’s Tax Law Clobbers State Budgets. Now’s the Time to Prepare.

August 13, 2025 • By Amy Hanauer

The Trump megabill hands the richest 1% a trillion-dollar windfall while gutting funding for health care, education, and disaster relief — leaving communities to pick up the pieces. State and local leaders must step up, tax the wealthiest fairly, and safeguard the essentials that keep America healthy, educated, and safe.

Mississippi’s Path to Income Tax Elimination Hinders Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

How Maryland’s Tax Reforms Advance Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Maryland is taking aim at income and racial disparities through a revised personal income tax. By raising taxes on high earners and cutting them for most households across racial and ethnic lines, the state is proving that progressive tax policy can drive both equity and revenue.

Trump’s Firing of BLS Commissioner is Part of Larger Erosion of Federal Data Infrastructure

August 7, 2025 • By Emma Sifre

Last week, President Trump fired the Commissioner of the Bureau of Labor Statistics in apparent retaliation for weak jobs numbers. The move drew sharp criticism for spooking investors and weakening trust in official data. But it also reflects a deeper problem: the ongoing erosion of the federal data infrastructure.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

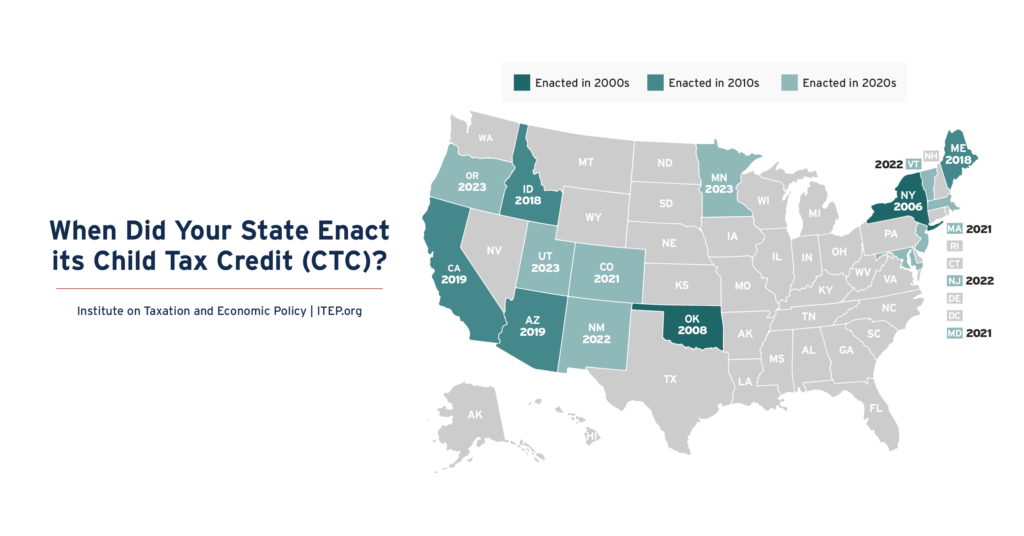

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

Excessive CEO Pay Makes Inequality Worse. Shareholders and the Public Deserve to Know About Compensation Disparities

July 30, 2025 • By Matthew Gardner

Huge executive pay packages are a prime driver of income inequality. Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.