Indiana: Who Pays? 7th Edition

Indiana

Download PDF

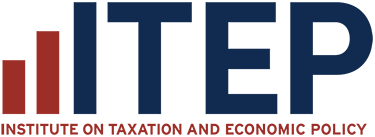

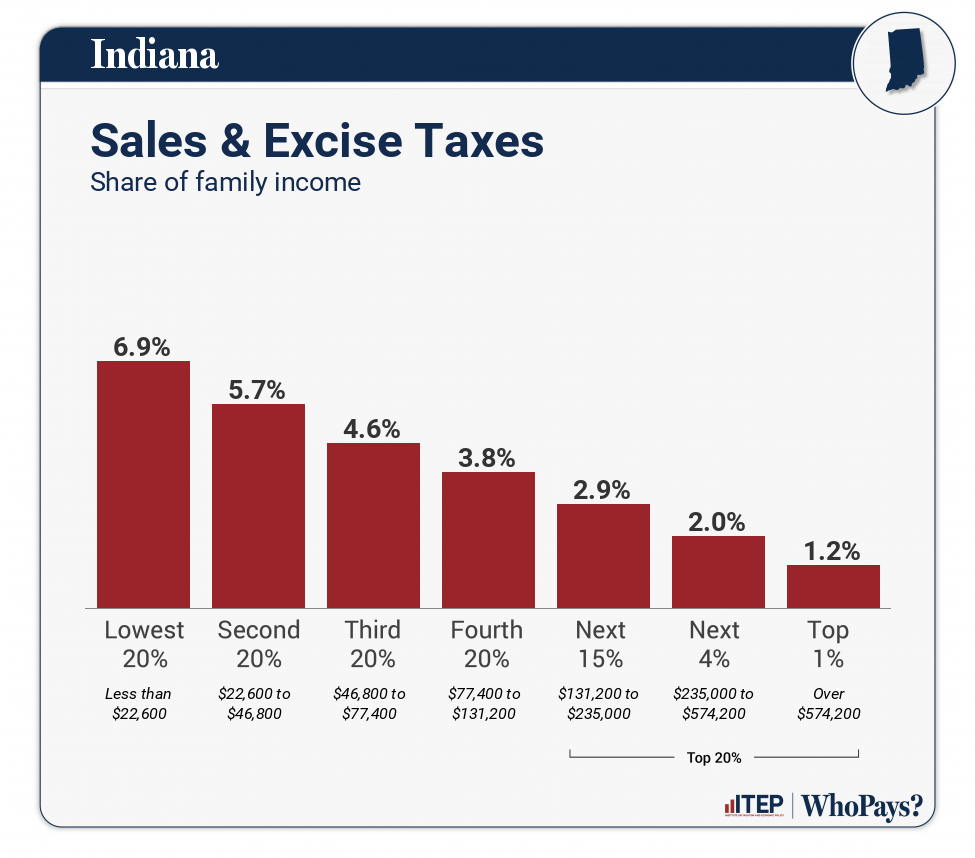

All figures and charts show 2024 tax law in Indiana, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Indiana. These figures depict Indiana’s flat personal income tax rate at 3.05 percent. The rate is set to decline to 2.9 percent over the next three years. As seen in Appendix E, this will decrease overall tax rates by 0.1 percentage points.

State and local tax shares of family income

| Top 20% | |||||||

| Income Group | Lowest 20% | Second 20% | Middle 20% | Fourth 20% | Next 15% | Next 4% | Top 1% |

| Income Range | Less than $22,600 | $22,600 to $46,800 | $46,800 to $77,400 | $77,400 to $131,200 | $131,200 to $235,000 | $235,000 to $574,200 | Over $574,200 |

| Average Income in Group | $12,700 | $32,900 | $60,300 | $101,800 | $164,400 | $323,600 | $780,400 |

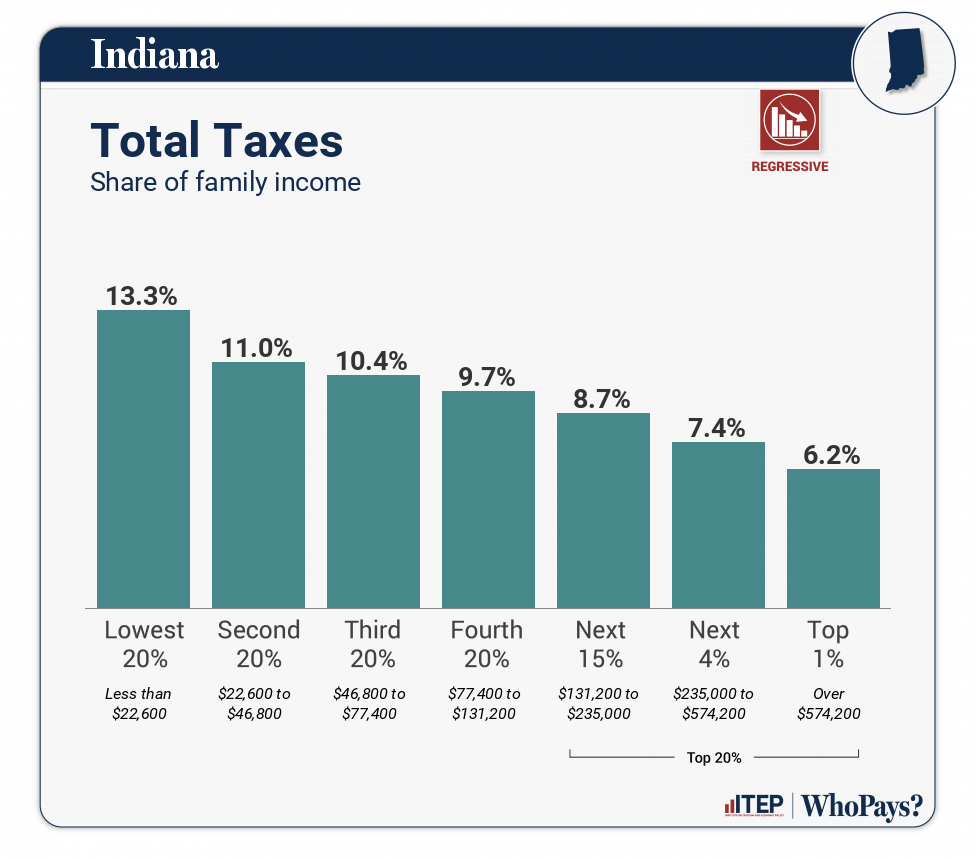

| Sales & Excise Taxes | 6.9% | 5.7% | 4.6% | 3.8% | 2.9% | 2% | 1.2% |

| General Sales–Individuals | 3.7% | 3.5% | 2.9% | 2.5% | 1.9% | 1.3% | 0.7% |

| Other Sales & Excise–Ind | 1.9% | 1.1% | 0.7% | 0.5% | 0.3% | 0.2% | 0.1% |

| Sales & Excise–Business | 1.2% | 1.1% | 0.9% | 0.8% | 0.7% | 0.6% | 0.4% |

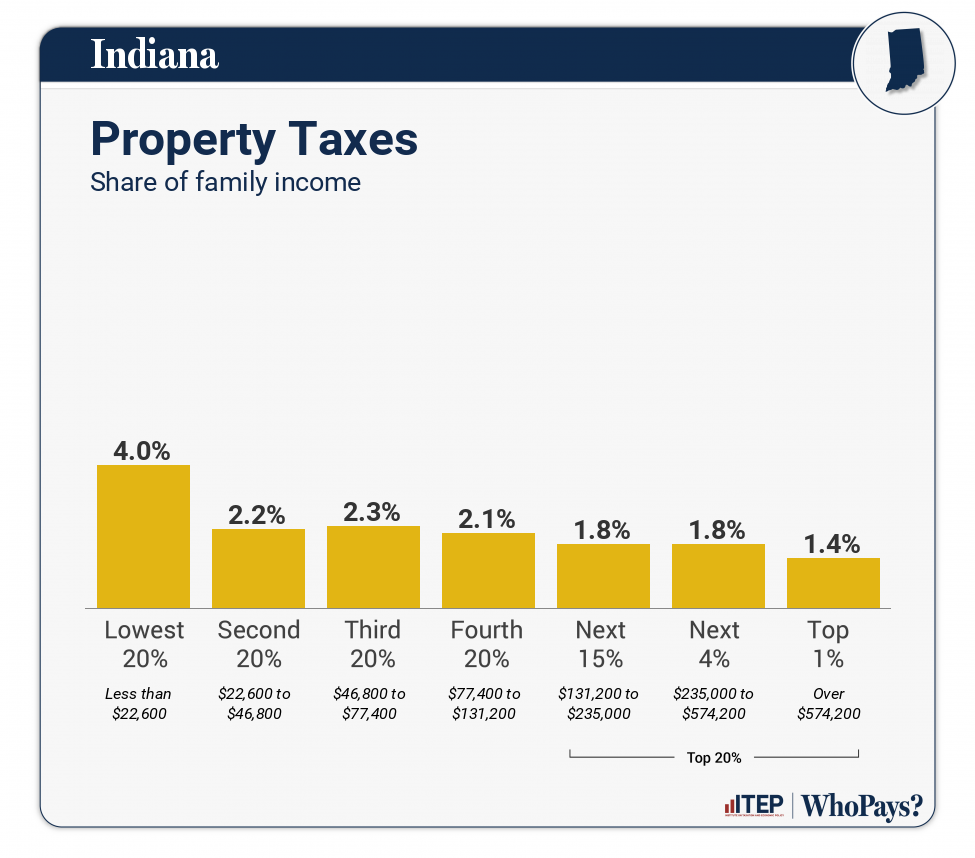

| Property Taxes | 4% | 2.2% | 2.3% | 2.1% | 1.8% | 1.8% | 1.4% |

| Home, Rent, Car–Individuals | 3.5% | 2% | 2% | 1.9% | 1.5% | 1.3% | 0.8% |

| Other Property Taxes | 0.5% | 0.3% | 0.3% | 0.3% | 0.3% | 0.4% | 0.5% |

| Income Taxes | 2.4% | 3% | 3.4% | 3.7% | 3.8% | 3.6% | 3.5% |

| Personal Income Taxes | 2.4% | 2.9% | 3.4% | 3.6% | 3.8% | 3.6% | 3.5% |

| Corporate Income Taxes | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Other Taxes | 0.1% | 0.1% | 0.1% | 0.1% | 0% | 0% | 0% |

| TOTAL TAXES | 13.3% | 11% | 10.4% | 9.7% | 8.7% | 7.4% | 6.2% |

| Individual figures may not sum to totals due to rounding. | |||||||

ITEP Tax Inequality Index

ITEP’s Tax Inequality Index measures the effects of each state’s tax system on income inequality. According to this measure, Indiana has the 14th most regressive state and local tax system in the country. Income disparities are larger in Indiana after state and local taxes are collected than before. (See Appendix B for state-by-state rankings and the report methodology for additional detail.)

Tax features driving the data in Indiana

|

Refundable Earned Income Tax Credit (EITC)

State sales tax base excludes groceries

|

|

|

No property tax “circuit breaker” credit for low-income taxpayers

Does not use combined reporting as part of its corporate income tax

Comparitively low Earned Income Tax Credit (EITC)

Does not levy a tax on estates or inheritances

Comparatively low-income tax exemptions

Personal income tax uses a flat rate

No Child Tax Credit (CTC)

|