State-by-State Data and ITEP Tax Inequality Index Map

Executive Summary

Who Pays? is the only distributional analysis of tax systems in all 50 states and the District of Columbia. This comprehensive 7th edition of the report assesses the progressivity and regressivity of state tax systems by measuring effective state and local tax rates paid by all income groups.[1] No two state tax systems are the same; this report provides detailed analyses of the features of every state tax code. It includes state-by-state profiles that provide baseline data to help lawmakers and the public understand how current tax policies affect taxpayers at all income levels.

Key Findings

- The vast majority of state and local tax systems are regressive, or upside-down. This requires a much greater share of income from low- and middle-income families than from wealthy families. The absence of a graduated personal income tax in many states and a heavy reliance on consumption taxes contribute to this effect.

- The lower one’s income, the higher one’s overall effective state and local tax rate. On average, the lowest-income 20 percent of taxpayers face a state and local tax rate nearly 60 percent higher than the top 1 percent of households. The nationwide average effective state and local tax rate paid by residents to their home states is 11.4 percent for the lowest-income 20 percent of individuals and families, 10.5 percent for the middle 20 percent, and 7.2 percent for the top 1 percent.

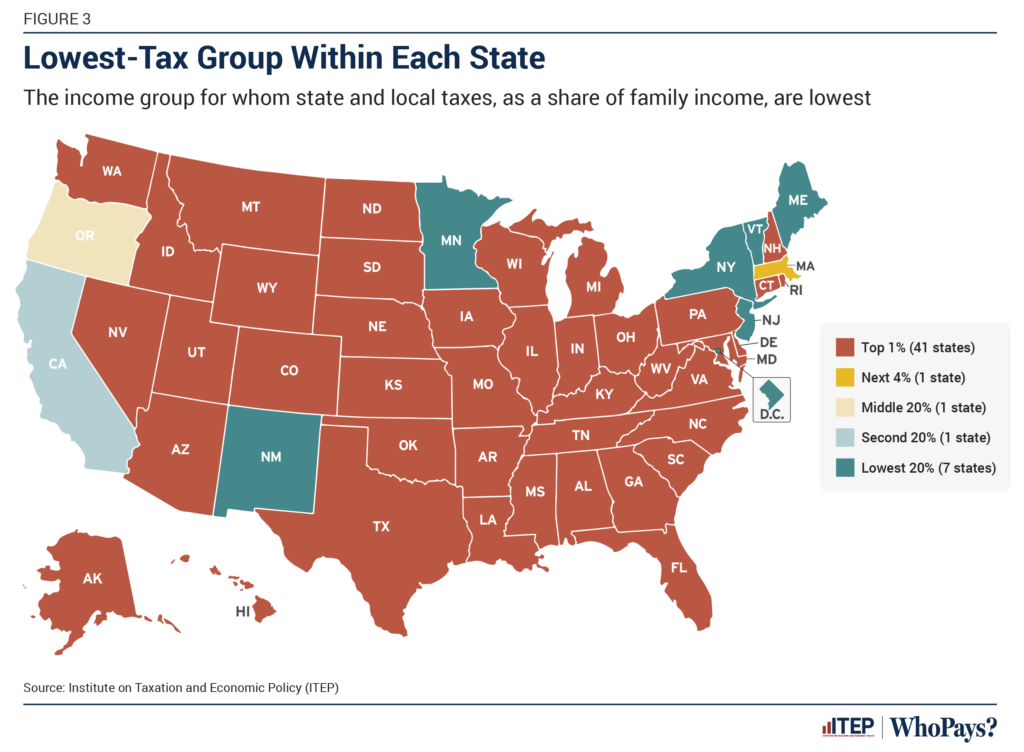

- In 41 states, high-income families are taxed at lower rates than everyone else. Our analysis sorts taxpayers into seven income groups and finds that in most states the top group, representing the top 1 percent of earners, pays a lower rate than any other group. Similarly, 42 states tax the top 1 percent at a lower rate than the bottom 20 percent, while 46 states tax the top 1 percent less than the middle 60 percent of earners.

- In 35 states, low-income families are taxed at higher rates than everyone else despite having the least ability to pay. Six states plus D.C., on the other hand, tax low-income families at lower rates. Nationally, comparatively high tax rates on low-income families remain the norm, despite recent steps to lower taxes for this group by bolstering refundable tax credits. Only six states and the District of Columbia now reserve their lowest overall tax rates for low-income families. Those states are Maine, Minnesota, New Jersey, New Mexico, New York, and Vermont.

- Tax structures in 44 states exacerbate inequality. Most state and local tax systems worsen income inequality by making incomes more unequal after collecting state and local taxes.

- Tax structures in six states and the District of Columbia reduce inequality. These half dozen states, plus D.C., narrow the gap between lower- and middle-income taxpayers and upper-income taxpayers, making the distribution of income more equal after collecting state and local taxes. Those states are California, Maine, Minnesota, New Jersey, New York, and Vermont.

- In the 10 states with the most regressive tax structures, the lowest-income 20 percent pay three times as much of their income in taxes as the wealthiest 1 percent. In Florida, home to the nation’s most regressive tax system, low-income families pay almost five times as much as the wealthy. After Florida, the next most regressive tax codes can be found in Washington, Tennessee, Pennsylvania, Nevada, South Dakota, Texas, Illinois, Arkansas, and Louisiana.

- Heavy reliance on sales and excise taxes makes tax systems more regressive. Eight of the 10 most regressive states rely heavily on sales and excise taxes. As a group, these eight states derive more than half of their tax revenue from these taxes, compared to a national average of about one-third. Heavy reliance on these taxes is largely a function of these states’ decision not to levy robust personal income taxes. Six of these states do not levy broad-based personal income taxes while two levy flat-rate taxes. Nationwide, the lowest-income 20 percent of taxpayers pay 7.0 percent of their income toward sales and excise taxes, the middle 20 percent pay 4.8 percent and the top 1 percent pay a comparatively meager 1 percent rate.

- A progressive, graduated rate income tax makes overall tax systems less regressive or more progressive. States with the least regressive state and local tax systems derive, on average, more than 39 percent of their tax revenue from income taxes, above the national average of 29 percent. These states promote progressivity through the structure of their income taxes, including graduated rates (higher marginal rates for higher-income taxpayers) and targeted refundable credits.

- States described as “low tax” are often high tax for low-income families. States such as Florida, Tennessee, and Texas are often described as “low tax” due to their lack of personal income taxes. While this characterization holds true for high-income families, these states levy some of the nation’s highest tax rates on the poor. This is indicative of a broader pattern. Nationally, we find evidence that states with lower taxes for their highest-income earners tend to have higher taxes for their lowest-income residents.

- Some states are passing policies that lessen tax regressivity. The rankings in this study include two new arrivals among the 10 least regressive states. New Mexico advanced 18 spots through reforms to refundable credits and more robust taxation of top earners. Massachusetts improved its ranking by 10 spots in just over a year, primarily through voter approval of a higher income tax rate on millionaires. At the other end of the rankings, Washington was able to shed its title as the nation’s most regressive tax jurisdiction with enactment of a new tax on capital gains and the creation of a tax credit for low- and moderate-income families. Other jurisdictions making notable strides toward lessening tax regressivity in recent years include Minnesota, New Jersey, New York, and D.C.

- Other states are passing policies that exacerbate tax regressivity. Arizona lawmakers made one of the sharpest moves toward heightened tax regressivity when they overrode a public vote in favor of higher taxes on top earners and enacted tax cuts for those families instead. The net effect of this reversal was to move Arizona from roughly the middle of the pack (27th) to one of the most regressive tax codes (13th) in the nation. In Kentucky, meanwhile, the state would have ranked 30th on the ITEP Index if it had left its previous tax code intact, but fell to 17th most regressive by switching to a flat-rate income tax and raising sales and excise taxes. If Kentucky continues on a path toward full elimination of its income tax, as some lawmakers would like to see, the state would come to have the 8th most regressive tax code in the nation. Other states recently moving in the direction of more regressive taxation include Arkansas, Idaho, Iowa, Mississippi, Nebraska, North Carolina, Ohio, and West Virginia—all of which have prioritized tax cuts for more affluent households and corporations.

Table of Contents

-

Introduction

-

In Most States, State and Local Tax Systems Worsen Inequality

-

The 10 Most Regressive State and Local Tax Systems

-

The Least Regressive State and Local Tax Systems

-

The Kind of Tax Matters

-

Income Taxes

-

Sales and Excise Taxes

-

Property Taxes

-

Other Taxes

-

Low Taxes or Just Regressive Taxes?

-

Conclusion

-

Appendices A-G

-

State-by-State Pages

-

Methodology

Introduction

The nation’s public policies helped grow the middle class, improve public health and economic well-being, and make access to K-12 education universal. Just as the nation’s tax policies have the power to improve well-being, the inverse is also true. Over the past four decades, income and wealth have become increasingly concentrated among the most affluent households, with immense disparities across race and ethnicity as well.[2]The reasons are complex and vast, but public policy has clearly contributed.

State and local tax policies play an important role in addressing or perpetuating inequality. Most state tax systems are regressive, meaning lower-income people are taxed at higher rates than top-earning taxpayers. Further, those among the top 5 percent of households pay a smaller share of all state and local taxes than their share of all income, while the bottom 95 percent pay more.

In other words, not only do the rich, on average, pay a lower effective state and local tax rate than lower-income people, they also collectively contribute a smaller share of state and local taxes than their share of all income. This limits states’ ability to raise revenue, particularly as inequality increases. Research shows that when income growth concentrates among the wealthy, state revenues grow more slowly, especially in states that rely more heavily on taxes that disproportionately fall on low- and middle-income households.[3]

Further, heavy tax cuts deprive state coffers of adequate revenue for schools, health care, and colleges – programs and services that build opportunity and improve well-being for families and communities. And yet, many state lawmakers doubled down on deep, permanent, and regressive tax cuts in 2023 and in years prior.

This study provides important context for those interested in state and local tax policies and the role they play in funding vital programs and services and providing economic security for all families and communities. It examines whether state tax systems are regressive or progressive by providing a thorough analysis of how state and local tax policies affect taxpayers across the income spectrum and discusses ways in which certain tax policies deepen racial disparities in income and wealth. Over 99 percent of all state and local taxes, measured by their revenue contribution, are included in this study.

Our analysis employs similar analytical techniques, and reaches broadly similar conclusions, to official incidence studies performed by state agencies in Minnesota, Texas, Connecticut, and Maine. Most states, however, do not conduct these kinds of comprehensive studies on a regular basis, in part because of the substantial amount of time and expertise it requires to do this work. We have devoted many thousands of hours of staff time to producing this 7th edition of Who Pays?, and we build on the work of prior ITEP analysts who themselves spent many hours thinking through and building earlier versions of the models employed in this study.

The headline conclusion of this research is that most states require low- and middle-income families to pay higher effective tax rates than the wealthy. This, of course, has broad implications, not only for taxpayers’ after-tax income but also for the revenue states collect to fund basic programs and services. There are, however, a handful of states that have taken meaningful steps toward lessening tax regressivity and have, in fact, managed to achieve progressive taxation throughout at least some parts of the income distribution.

Nationally, the average state levies an effective state and local tax rate of 11.4 percent for its lowest-income 20 percent of residents; 10.5 percent for the middle 20 percent; and 7.2 percent for the top 1 percent (see Figure 1). This means the top 1 percent are contributing 37 percent less of their incomes toward funding state and local services in their states than the poorest families. Results vary widely by state. For detail on the impact in individual states, see Appendix G for the state-by-state Who Pays? summaries.

In Most States, State and Local Tax Systems Worsen Inequality

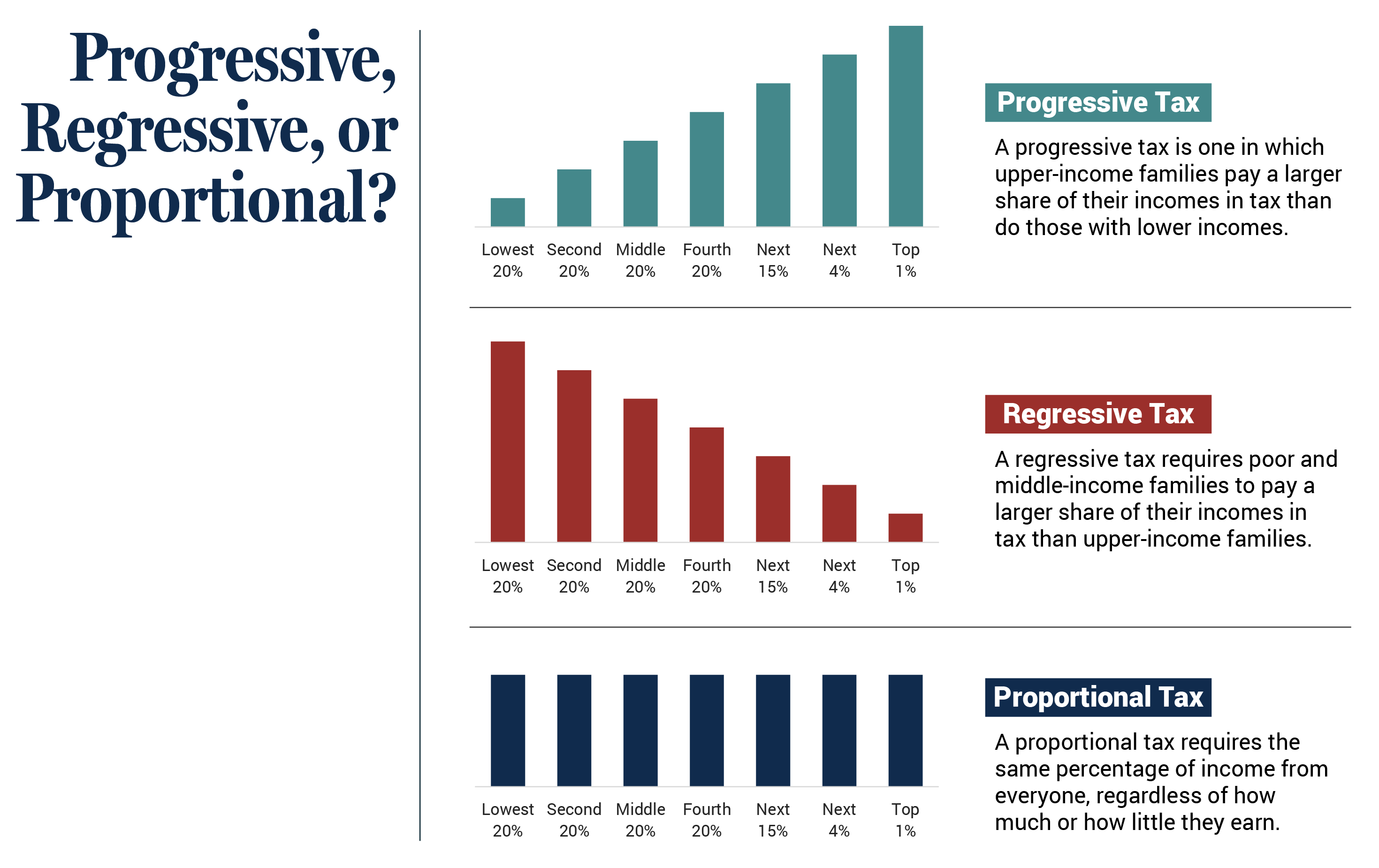

Forty-four states’ tax systems exacerbate income inequality. When the lowest-income households pay the greatest proportion of their income in state and local taxes, gaps between the most affluent and everyone else grow larger.

The ITEP Tax Inequality Index measures the effects of each state’s tax system on income inequality by assessing the impact state tax policy has on the post-tax incomes of taxpayers at different income levels. Essentially, it answers the following question: Are incomes more, or less, equal after state taxes than before?

If high-income taxpayers are left with a higher percentage of their pre-tax income to spend on their day-to-day living and to save for the future than low- and middle-income taxpayers, the tax system is regressive and receives a negative Tax Inequality Index value. This indicates that the income inequality that existed before the levying of state and local taxes has been made worse by those taxes.

On the other hand, states with progressive tax structures have positive Tax Inequality Index values. This means that, after taking state and local taxes into account, incomes are no less equal than they were before taxes and have, in fact, been made more equal across at least some groups. Tax systems in those states did not worsen income inequality overall though, in practice, each of the states with positive Index values in this study does still have moderately regressive effects through portions of the income scale. Vermont, for example, taxes its top 5 percent of earners at slightly lower rates than upper-middle income families yet still manages to receive a positive Index value overall because its tax system is progressive through the bottom 95 percent of the income scale and its tax rates at the very top are not dramatically lower than those charged to other groups.

FIGURE 2

ITEP Tax Inequality Index

States in order of rank from most to least regressive

| 1 | Florida |

| 2 | Washington |

| 3 | Tennessee |

| 4 | Pennsylvania |

| 5 | Nevada |

| 6 | South Dakota |

| 7 | Texas |

| 8 | Illinois |

| 9 | Arkansas |

| 10 | Louisiana |

| 11 | Wyoming |

| 12 | Alabama |

| 13 | Arizona |

| 14 | Indiana |

| 15 | Ohio |

| 16 | Oklahoma |

| 17 | Kentucky |

| 18 | New Hampshire |

| 19 | Mississippi |

| 20 | Alaska |

| 21 | Connecticut |

| 22 | Hawaiʻi |

| 23 | Iowa |

| 24 | North Carolina |

| 25 | North Dakota |

| 26 | Kansas |

| 27 | Wisconsin |

| 28 | West Virginia |

| 29 | Utah |

| 30 | Nebraska |

| 31 | Missouri |

| 32 | Rhode Island |

| 33 | Georgia |

| 34 | South Carolina |

| 35 | Michigan |

| 36 | Idaho |

| 37 | Virginia |

| 38 | Montana |

| 39 | Colorado |

| 40 | Delaware |

| 41 | Maryland |

| 42 | Oregon |

| 43 | New Mexico |

| 44 | Massachusetts |

| 45 | Maine |

| 46 | New Jersey |

| 47 | California |

| 48 | New York |

| 49 | Vermont |

| 50 | Minnesota |

| 51 | District of Columbia |

Note: See Appendix B for detailed ITEP Tax Inequality Index and Methodology for more information.

A full description of how the Index is calculated is provided in Appendix H. The Index works by measuring differences in tax impacts at various points across the income scale and distilling those differences into one headline number.

Readers may also be interested in seeing direct comparisons across income groups. For instance:

- 41 states tax the top 1 percent at a lower rate than any other income group. Six states and the District of Columbia, on the other hand, reserve their lowest tax rates for their lowest-income residents.

- 42 states tax the top 1 percent at a lower rate than the lowest 20 percent.

- 46 states tax the top 1 percent at a lower rate than middle-income earners. This remains true regardless of whether that group is defined to include families in the middle 20 or middle 60 percent of the income distribution.

- 35 states tax the lowest 20 percent of earners at a higher rate than any other income group.

Some of these findings can be seen in Figure 3, which identifies the lowest-taxed group in each state. More often than not, that group is the state’s most affluent families.

The 10 Most Regressive State and Local Tax Systems

Ten states — Florida, Washington, Tennessee, Pennsylvania, Nevada, South Dakota, Texas, Illinois, Arkansas, and Louisiana — are particularly regressive, with upside-down tax systems that ask the most of those with the least. These states tax their poorest residents — those in the bottom 20 percent of the income scale — at rates averaging three times higher than those charged to the wealthy. Middle-income families in these states pay an average rate more than twice as high a share of their income than the wealthiest families. Florida, which has the most regressive state tax system in the nation, fares worst by these two measures, with low-income families paying almost 5 times more than the wealthy and middle-income families paying more than 3 times more.

What characteristics do states with particularly regressive tax systems have in common? Highly regressive tax codes can be found in all regions of the country and in states with divergent political leadership. That being said, there are some clear tax policy patterns across these 10 states. Several important factors stand out:

Six of the 10 states do not levy a broad-based personal income tax — Florida, Washington, Tennessee, Nevada, South Dakota, and Texas. Taxes on consumption and property, as discussed later, are nearly always regressive. The absence of an income tax makes it all but impossible for these states to counterbalance these regressive levies.

Two states levy personal income taxes without graduated rates, making them much less progressive than in other states. Pennsylvania and Illinois use a flat rate for their personal income taxes, which taxes the income of each state’s wealthiest families at the same marginal rate as the poorest wage earners. Local income tax rules in Pennsylvania, which rely heavily on wage taxes, further erode the progressivity of the state’s overall income tax system.

Eight of the 10 most regressive tax systems — Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana — rely heavily on regressive sales and excise taxes. As a group, these eight states derive 52 percent of their tax revenue from these taxes, compared to the national average of 34 percent (see Appendix C). These consumption taxes, based on spending rather than income or ability to pay, are the most regressive major tax category and the most significant drivers of economic and racial inequality in state and local tax codes.

The Least Regressive State and Local Tax Systems

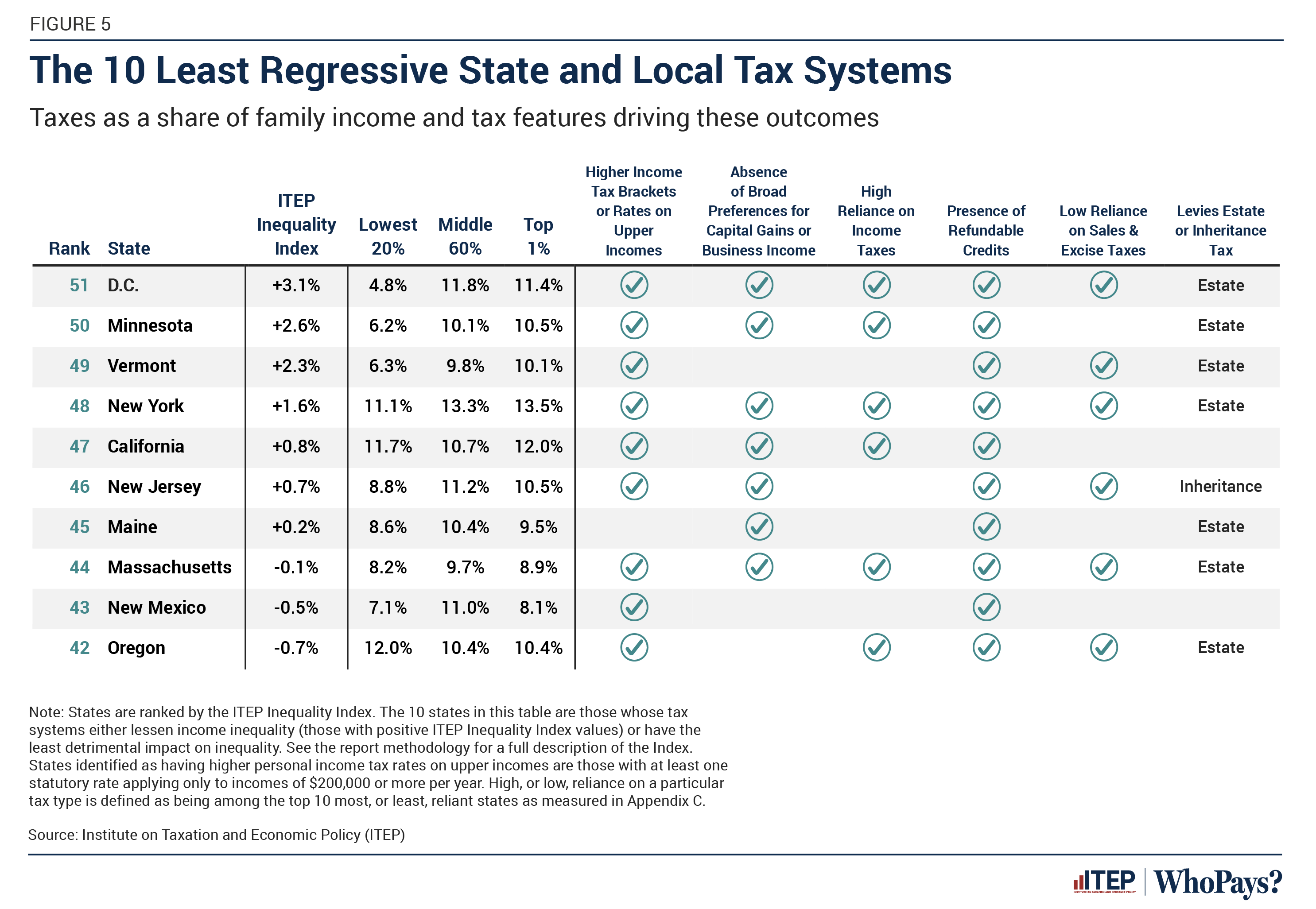

Ten jurisdictions with more equitable state and local tax systems can be found in Figure 5. Seven of the 10 — the District of Columbia, Minnesota, Vermont, New York, New Jersey, Maine, and California — receive positive values on ITEP’s Tax Inequality Index, meaning that their state and local tax systems do not worsen income inequality overall and actually lessen inequality across some groups. The other three—Massachusetts, New Mexico, and Oregon—have tax codes that tilt slightly regressive overall.

None of the tax systems in these states are robustly progressive in a traditional sense. The District of Columbia, for example, ranks as the least regressive jurisdiction in the nation, and yet the top 5 percent of DC families still pay a lower rate (11.2 percent) than the bottom 95 percent (11.6 percent). Rather than seeing effective tax rates steadily rise throughout the entire income distribution, some of these jurisdictions see “peaks” where taxes on middle-income families are somewhat higher than at the top, or “valleys” where low-income families face higher rates than the middle-class.

Despite these lingering issues, the states described in this section have tax codes that look quite different from the highly regressive states described in the previous section. Several important factors define states with more equitable tax systems:

Highly progressive income tax brackets and rates. All the most equitable tax systems include personal income taxes which are progressive (to varying degrees). California’s overall tax system, for example, is relatively progressive largely because of its graduated marginal income tax rates and limits on tax preferences for upper-income taxpayers.

Use of targeted, refundable low-income credits. All 10 states with more equitable tax systems offer refundable Earned Income Tax Credits, with EITCs in 8 of the 10 states equal to or exceeding a quarter of the federal credit for most recipients. In addition, nine of these 10 states offer refundable Child Tax Credits. Refundable credits to offset sales and property taxes are also common. Maine, for instance, provides a refundable sales tax credit, dependent care tax credit, and a property tax “circuit breaker.”

Broad-based income taxes. State personal income taxes with few deductions or exemptions benefiting the wealthy (such as capital gains preferences or itemized deductions) tend to be progressive. Targeted policies to reduce these benefits for higher-income earners can improve both the progressivity and revenue yield of state income tax structures.

Higher reliance on income taxes and lower reliance on regressive consumption taxes. Just as the combination of flat (or nonexistent) income taxes and high sales and excise taxes leads to regressive tax systems, the least regressive tax systems have highly progressive income taxes and rely less on sales and excise taxes.

The Kind of Tax Matters

State and local governments have historically used three broad types of taxes to fund public services: income, property, and consumption (sales and excise). States also rely on a range of non-tax revenue sources such as fees, fines, service charges, and royalties, as well as transfers from the federal government. A few states rely heavily on non-traditional tax sources, such as severance taxes on the extraction of natural resources. (See Appendix C for 50-state data on the importance of various tax types, and non-tax revenues, to state and local budgets.)

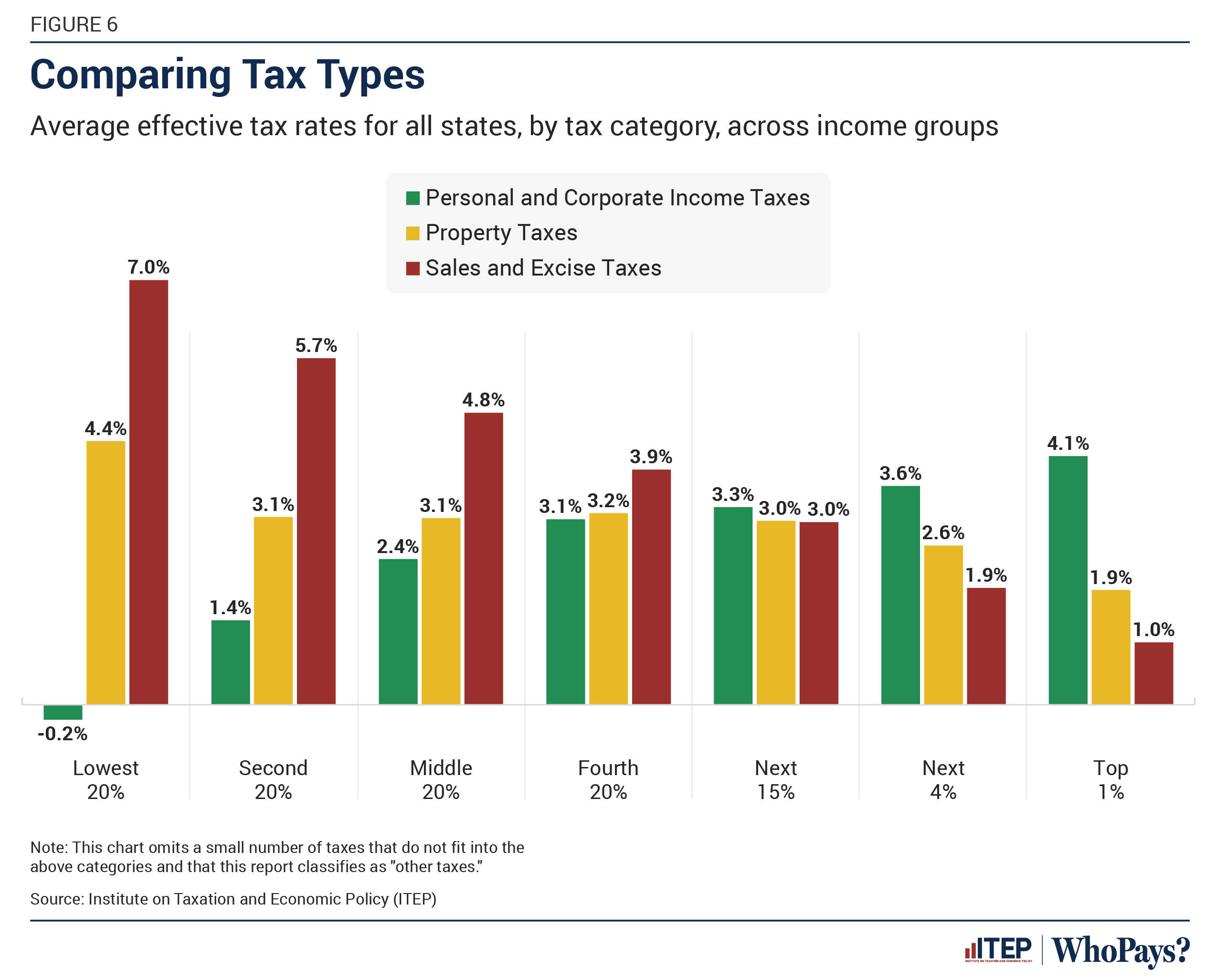

The regressivity or progressivity of state tax systems depends primarily on how heavily states rely on these different tax types. Each has a distinct distributional impact, as Figure 6 illustrates.

Personal and corporate income taxes are typically progressive — as incomes go up, effective tax rates go up.

On average, low-income families receive a slight rebate through state and local income tax laws, amounting to 0.2 percent of their incomes, which helps to offset the comparatively high property and sales taxes they pay. Middle-income families pay 2.4 percent of their incomes toward these taxes on average while the top 1 percent pay 4.1 percent. Of the three major taxes used by states, the personal income tax is the only tax under which effective tax rates rise with income levels. States often use progressive income taxes to help offset more regressive state and local taxes.

Property taxes, on both individuals and businesses, are usually somewhat regressive.

On average, low-income homeowners and renters pay more of their income in property taxes than any other income group — and the wealthiest taxpayers pay the least. Nationally, low-income families pay 4.4 percent of their incomes toward property taxes of all types, middle-income families pay 3.1 percent of their incomes, and the top 1 percent pay 1.9 percent.

Sales and excise taxes are very regressive.

Poor families pay almost seven times more as a share of their incomes in these taxes than the best-off families, and middle-income families pay almost five times the rate of the wealthy. On average low-income families pay 7 percent of their incomes in sales and excise taxes, middle-income families pay 4.8 percent of their incomes, and the top 1 percent pay 1 percent.

Race Matters

Historic and current injustices in public policy and broader society have resulted in vast disparities in income and wealth across race and ethnicity. Unequal opportunities to access education, housing, jobs, capital, and other economic resources have resulted in stark income and wealth gaps between white families and most communities of color. Black and Hispanic families each earn around $35,000 less in income every year, at the median, than white families. Racial wealth gaps are even more pronounced: the median Hispanic household owns roughly 78 percent less wealth than the median white one, while the median Black household owns about 84 percent less.

The distributional impact of state and local tax systems based on income has implications for racial wealth inequality. State tax codes that worsen income inequality by taxing lower-income people at higher rates than high-income people, taxing income derived from wealth (e.g., capital gains) at a lower rate than income derived from work, or relying heavily on consumption taxes, risk worsening the racial wealth divide.

Previous ITEP research demonstrated this with an in-depth analysis of two states with starkly different tax codes: Minnesota and Tennessee.[4] In Tennessee, we found that Black and Hispanic families pay roughly 1 percent more of their income toward state and local taxes than the statewide average. In Minnesota, by contrast, Black, Hispanic, and Indigenous families paid rates ranging from 0.4 to 0.7 percent below the statewide average. In other words, Minnesota’s tax code tends to reduce racial income disparities whereas Tennessee’s tends to increase them.

The income and wealth gap between white families and communities of color will not be eliminated by making state tax systems more equitable. Fully addressing these disparities will require a concerted effort across policy areas at all levels of government. That being said, our findings from Minnesota and Tennessee demonstrate that state and local tax policy matter in addressing these disparities. There is no shortage of policy options for lawmakers who want to make their state’s tax system a more powerful force for advancing racial equity or who, at the very least, want to avoid compounding existing inequities through the tax code. Most robust taxation of top incomes and wealth, offering meaningful refundable tax credits, and avoiding overreliance on regressive tax sources are all proven options for accomplishing those goals.[5]

A state tax system’s progressivity is only partially determined by the mix of these three broad tax types. Equally important is how states structure each tax. By design, some personal income taxes are far more progressive than others. The same is true, to a lesser extent, of property and sales taxes; while any state that relies heavily on these taxes is likely to have a regressive tax structure, lawmakers can take steps to make these taxes less regressive. The overall structure of a state’s tax system, therefore, ultimately depends both on a state’s reliance on the different tax sources and how the state designs each tax.

For example, Minnesota’s level of reliance on sales and excise taxes is somewhat below the national average. Instead, it relies more heavily on income taxes and its personal income tax is significantly more progressive than most. This makes Minnesota’s tax system the second least regressive in the country, behind only the District of Columbia.

Florida, on the other hand, has the most regressive state and local tax system. This is largely a result of the state levying no personal income tax and relying heavily on sales and excise taxes —these taxes make up over half of the state’s total tax collections. The average state’s level of reliance on sales and excise taxes is about a third lower than that, at 34 percent.

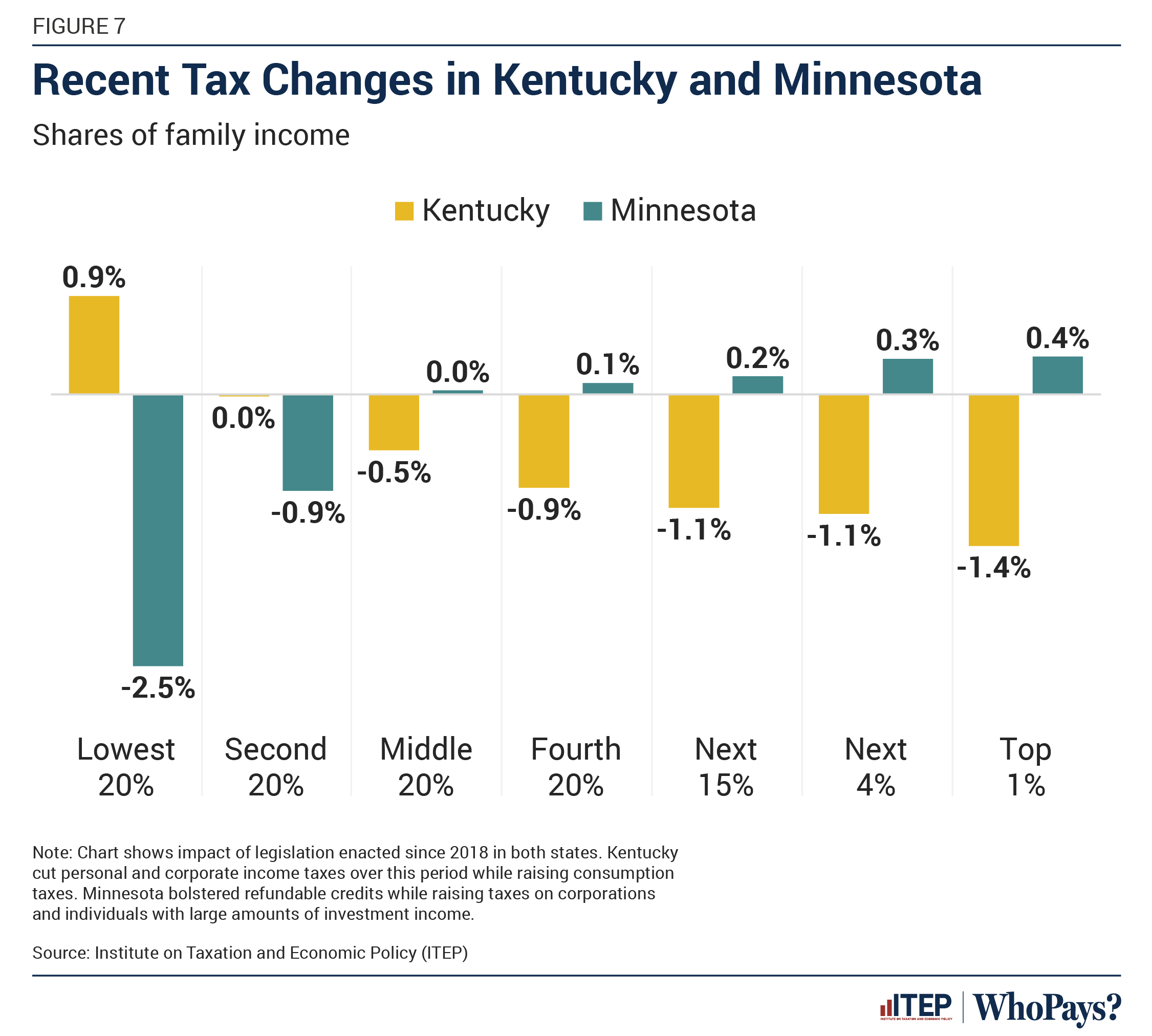

Steps Toward, and Away, From Tax Regressivity in Kentucky and Minnesota

State tax policy has changed significantly in the last few years as lawmakers have rewritten substantial portions of their tax codes. While some tax increases have been enacted in recent years, state lawmakers have tended to put far greater energy into tax cutting. These cuts look very different across states. This becomes clear by examining two states that have been pursuing wildly different tax policy trajectories: Kentucky and Minnesota.

Starting in 2018, Kentucky converted its graduated rate income tax into a flat tax and repeatedly reduced the tax rate. It also lowered corporate taxes. These sizeable tax cuts have delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides. The net result of this tax swap has been to raise taxes on low-income families while cutting them for upper-income families. Figure 7 shows that low-income families have had to pay almost 1 percent more of their income in tax because of these higher taxes on their purchases, while high-income families have enjoyed tax cuts equal to 1.4 percent of their income through lower personal and corporate tax payments. The net effect of these changes has been to steepen what was already a regressive tax code in Kentucky, and to lower the state’s ITEP Inequality Index value from 30th to 17th most regressive.

Minnesota, by contrast, embarked on a sharply different course over this period by enacting tax increases on corporate profits and high-income families, including those with large amounts of investment income. It paired those tax increases with larger tax credits for low-income workers and families with children. Figure 7 shows that the net effect has been to lift the incomes of the state’s poorest families by more than 2 percentage points, while raising taxes on the state’s most affluent households by 0.3 to 0.4 percent of their income. This package of changes has moved Minnesota’s ITEP Inequality Index value from 47th to 50th least regressive, meaning that today only the District of Columbia has a less regressive tax code than Minnesota.

A close look at Kentucky and Minnesota’s overall distributional results (available on each state’s dedicated results page) yields another important finding. While Minnesota enjoys more robust state and local tax revenues than Kentucky, measured relative to the size of those two states’ economies, Minnesota’s higher tax rates at the top of the income scale allow it to generate these revenues while taxing low- and middle-income families at lower rates than Kentucky. Effective tax rates across the bottom 60 percent of the income distribution in Minnesota range from 6.2 and 10.0 percent of income, while effective rates for the same groups in Kentucky vary from 10.9 to 12.4 percent of income.

Looking ahead, there is reason to think that the difference between Kentucky and Minnesota results could grow wider. Kentucky’s HB 8, enacted in 2022, allows lawmakers—when specific conditions are met—to lower the income tax rate in 0.5 percent increments until it is completely eliminated. Full elimination would be enough to cause Kentucky to slip another 9 spots in the ITEP Inequality Index rankings, leaving it with the 8th most regressive tax code in the nation. Of course, income tax elimination would come with an extremely high price tag and, in practice, is likely to be paired with more and higher taxes on families’ spending—continuing the trend the state kicked off in 2018. Such a pairing would lead to an even more regressive tax code for the Bluegrass State.

Additional data on the impact of past legislation are available in Appendix D, while forecasts of the impact of scheduled changes in Kentucky and elsewhere are available in Appendix E.

The Past, Present, and Future of State and Local Tax

The centerpiece of this report is a snapshot in time: a look at state and local tax law in Tax Year 2024. But a single snapshot can only do so much to illuminate the rapidly evolving landscape of state and local tax. The last few years have brought tremendous tax policy changes, and the years ahead are likely to bring even more. To help readers better understand the very different paths states have taken, or are currently debating, we have included three new appendices of data on the effects of past and future tax law on some states’ overall distribution, and their ITEP Inequality Index ranking. These appendices are as follows:

- Appendix D compares 2024 law in select states to a previous version of state law prior to the enactment of significant tax policy changes.

- Appendix E looks ahead to changes that are written into state law with a delayed implementation date. These tax changes, often implemented with revenue triggers or gradual phase-ins, have become increasingly common among states pursuing deep tax cuts because they push the revenue consequences of those cuts outside of the current budget window.

- Appendix F examines select major proposals floated by top lawmakers in a handful of states. These analyses are meant to clarify what high-profile tax policy changes would mean for states’ overall distributional outcomes.

Taken together, these data show the tremendous potential of tax reform to either lessen, or exacerbate, tax regressivity and economic inequality.

Of the states analyzed in these appendices, New Mexico stands out for moving 18 spots in the Index rankings through reforms to refundable credits and more robust taxation of capital gains, among other policy changes. Massachusetts was the next biggest mover among the states we examined, advancing 10 spots through a combination of a voter-approved income tax increase on millionaires and legislatively approved enhancements to refundable credits. And Washington, while still having one of the most regressive tax codes in the country, was able to shed its title of most regressive state with a new tax on long-term capital gains and a low-income credit patterned after the federal EITC.

Other states, however, have enacted tax policy changes that compounded the substantial regressivity already present in their tax codes. Arizona made a sharp move toward heightened regressivity as lawmakers decided to override a public vote in favor of higher taxes on top earners, and to enact tax cuts for the state’s wealthiest families instead. This reversal cost the state 14 spots in the Index rankings and left it with the 13th most regressive tax code in the nation.

Arkansas’s tax code is now one of the 10 most regressive in the nation (ranking 9th) as the state lost 6 spots in the rankings through a series of personal and corporate income tax cuts. Nebraska is scheduled to lose 10 spots through implementation of its own, top-heavy personal and corporate income tax cuts.

Looking ahead, some of the highest-profile tax debates yet to come will be over eliminating state personal income taxes in states like Kentucky and West Virginia (which already have triggered elimination laws on the books) as well as Arkansas, Indiana, Iowa, Mississippi, and Oklahoma. The revenue cost of income tax elimination in any of these states would be immense.

And, as Appendices E and F show, the final result would be to leave these states with tax codes that rank among the most regressive in the nation even if sales and excise taxes are not increased to offset some of the cost—as is likely to occur in practice.

Income Taxes

State income taxes on personal income and corporate profits are the main progressive elements of state and local tax systems. Robust taxation of top incomes and large corporate profits can lessen disparities across both economic and racial lines.[6] In 2024, 41 states and the District of Columbia have broad-based personal income taxes while 44 states plus D.C. levy corporate profits taxes. (Alaska, Florida, New Hampshire, and Tennessee tax corporate profits despite not taxing personal income broadly, while Ohio taxes personal income but subjects corporations to a gross receipts tax in lieu of a profits tax.)

Personal Income Tax Landscape

Personal income taxes are one of the most significant revenue sources used at the state level and typically offset at least some of the regressivity of consumption taxes and property taxes, though they vary considerably in how well they do so. Some states, such as California, Minnesota, and Vermont, as well as the District of Columbia, have very progressive income taxes that compensate for most of the regressivity inherent in other taxes. A larger group of states levies income taxes that are only moderately progressive and don’t fully offset regressivity elsewhere in their tax codes. Very few states, such as Alabama and Pennsylvania, have income tax systems that are themselves regressive throughout significant portions of the income distribution.

These differences in progressivity of state income taxes are due to three broad policy choices: whether the tax structure is flat or graduated,[7] whether the state grants regressive tax exemptions and deductions that go disproportionately to the wealthiest,[8] and whether the state offers refundable tax credits that benefit low- and middle-income people.[9]

Personal Income Tax Rate Structures

Of the states currently levying a broad-based personal income tax, all but 12 apply graduated tax rates (higher tax rates for higher income levels). Under a graduated tax, different portions of one’s income can be taxed at different rates, with high-income families seeing more of their income taxed at higher rates than other families.

Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Kentucky, Michigan, Mississippi, North Carolina, Pennsylvania, and Utah tax income at one flat rate.[10] While the bulk of the most regressive states have no income taxes at all, two of the 10 most regressive — Pennsylvania and Illinois — find themselves in this group in part due to their use of a flat-rate income tax.

Using a graduated rate structure is not enough to guarantee a robustly progressive income tax overall, especially if the tax brackets are compressed at the bottom end of the income scale or if there are only minor differences in the tax rates charged within different brackets. Some graduated-rate income taxes are about as progressive, or even less progressive, than some flat-rate taxes. The distributional effects of income taxes depend both on the level of graduation in the tax bracket design, and on the tax base choices discussed in the next two sections.

Undermining Progressivity with Tax Subsidies for Wealthy Taxpayers

While discussion over income tax progressivity tends to focus on the tax rates being charged, the choice of tax base also matters immensely to the final distribution of state and local income tax systems. The following discussion touches on five of the most common and substantial income tax carveouts that can curb, or even reverse, the progressivity of state income tax laws.

Capital gains are profits from the sale of assets such as stocks, bonds, real estate, and antiques. Nine states (Arizona, Arkansas, Hawaiʻi, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin) provide income tax deductions or preferential rates for all long-term capital gains income. Other states—such as Connecticut, Idaho, Kansas, Kentucky, Louisiana, Maine, Maryland, Mississippi, Nebraska, New Jersey, North Carolina, and Oklahoma—offer tax reductions for realized gains from certain assets located solely within state boundaries.[11] These tax subsidies disproportionately benefit high-income and high-wealth families and tend to worsen economic inequality across both economic and racial dimensions. One recent analysis found that just 2 percent of the tax cuts associated with federal capital gains tax preferences flow to Black households, and just 3 percent flow to Hispanic households.[12] Minnesota recently became the first state with a broad-based income tax to buck the national trend and levy higher taxes on wealthy families’ long-term capital gains than on their salaries or wages.

Pass-through business income represents the profits earned by partnerships, S corporations, and other so-called “pass-through” entities. Historically this income has been taxed at the same rate as salaries and wages, but a handful of states have recently decided to privilege it over other forms of income, spurred on in part by Congress’ decision to provide a 20 percent write-off for this income under the Tax Cuts and Jobs Act of 2017. Colorado, Idaho, Iowa, Missouri, North Dakota, Ohio, Oregon, and South Carolina currently provide tax advantages to pass-through business income. Much like subsidies for capital gains, preferential treatment of pass-through businesses advantages high-income and disproportionately white taxpayers. The same analysis referenced above found that just 2 percent of the federal government’s pass-through tax preferences reach Black taxpayers and just 5 percent reach Hispanic taxpayers.

Itemized deductions afford upper-income families with the opportunity to reduce their state taxable income based on the amount of certain expenses they incur such as mortgage interest, property tax, or charitable gifts. Most states with income taxes offer some itemized deductions, though many limit them in some way for upper-income families.[13] Rhode Island and Vermont are the most recent states to eliminate itemized deductions outright.

Carveouts for retirement income are often poorly targeted, allowing high-income seniors to pay less tax than younger families with much lower incomes. Some of these subsidies are so sweeping that they are akin to offering senior citizens an entirely separate tax system than younger families (seniors are excluded from the distributional estimates contained in this report in part for this reason, as discussed in the report’s methodology). Senior tax subsidies reduce state personal income tax revenues nationwide by roughly 9 percent, with a large share of those subsidies flowing to relatively affluent seniors.[14]

Deductions for federal income taxes paid allow taxpayers to reduce their state taxable income by the amount of federal income tax they pay. Because the federal income tax is progressive, this state policy tilts heavily in favor of upper-income families. This deduction has gradually fallen out of favor at the state level. Alabama is the only state to allow a full deduction for federal income taxes paid in 2024, while Missouri and Oregon each allow partial deductions.[15] The effects of Alabama’s deduction on its overall income tax code are dramatic: despite levying a 5 percent top income tax rate, the actual effective tax rate on the state’s highest-income earners is less than 3 percent.

Taxing top incomes is among the most direct ways of lessening income inequality along racial and economic lines while raising substantial revenue to fund public investments that also combat inequality. But ensuring equity in state income tax laws requires looking beyond tax rates and paying close attention to the tax base—that is, the types of income being taxed, and the types of tax preferences being offered.[16]

Income Tax Credits Benefitting Low- and Moderate-Income Families

Refundable state tax credits can enhance income tax progressivity and lift people up and out of poverty. These are most effective when they are adjusted for inflation, so they do not erode over time, and when they are refundable, meaning that low earners who do not owe income tax (but still pay sales, excise, and property taxes) get the full value of the credit.

Thirty-one states plus the District of Columbia have Earned Income Tax Credits (EITCs).[17] Most states allow filers to calculate their EITC as a percentage of the federal credit. This makes the credit easy for state taxpayers to claim (since they have already calculated the amount of their federal credit) and straightforward for state tax administrators. In all but six states, the EITC is fully refundable: Missouri, Ohio, South Carolina, and Utah have nonrefundable credits and Delaware and Virginia offer partial refundability. Many states have taken steps to make their credits more inclusive than the federal credit by providing access to immigrants who file taxes using Individual Taxpayer Identification Numbers (ITINs),[18] expanding age eligibility to workers without children in the home,[19] boosting the credit for extremely low-income families, and considering monthly payment options. These actions can chip away at racial and wealth inequality, blunt some of the regressivity of state and local tax systems, and help families meet their basic needs.

In 2024, 14 states provide Child Tax Credits (CTCs) to reduce poverty, boost economic security, and invest in children.[20] This is a significant increase from just a few years prior—a shift due, in large part, to states seeking to emulate the success of a temporary expansion to the federal CTC that was in effect for 2021. The American Rescue Plan Act of 2021 drastically reduced child poverty through an expanded CTC, cutting it by 46 percent by lifting 3.7 million children out of poverty before it lapsed at the end of that year. State lawmakers can design CTCs to complement the federal credit and achieve sizable child poverty reductions within their borders.[21] To maximize impact, lawmakers should make their credits fully refundable by granting access to the full credit even for those with little or no income, set a maximum amount per child instead of per household, set state-specific phaseout ranges that target low- and middle-income families, index to inflation, and offer the option of advanced payments.

Refundability ensures that families and children receive the full benefit of the credits. Refundable credits do not depend on the amount of income taxes paid; rather, if the credit exceeds income tax liability, the taxpayer receives the excess as a refund. This helps offset regressive sales, excise, and property taxes and can provide a much-needed income boost to help families afford necessities. Low-income tax credits such as an EITC or CTC are important indicators of tax progressivity: only three of the 10 most regressive state tax systems have an EITC and none have a CTC, while all of the 10 relatively progressive state tax systems provide a refundable EITC and nine provide a CTC.

Lawmakers have other types of refundable credits available to them as well. Six states offer an income tax credit to help offset the sales and excise taxes that low-income families pay. Some of the credits are specifically intended to offset the impact of sales taxes on groceries. These credits are normally a flat dollar amount for each family member and are available only to taxpayers with income below a certain threshold. They are usually administered on state income tax forms and are refundable — meaning that the full credit is given even if it exceeds the amount of income tax someone owes.

The credits described above advance the economic security of a diverse group of families of many races and ethnicities, but they can be particularly powerful for Black, Hispanic, Indigenous, and other people of color confronting economic hardship created by systematic race-based injustices in our broader society and our tax systems.

A Demonstration of Differences in Personal Income Tax Structures

The previous three sections discussed how differences in personal income tax rates, bases, and credits shape the final distribution of state and local income tax laws. Figure 8 demonstrates this point by comparing three places with dramatically different approaches to income taxation: the District of Columbia, West Virginia, and Pennsylvania.

The District of Columbia’s income tax is quite progressive. Its six-tier graduated tax rates range from 4 percent to 10.75 percent. Because the top tax rate of 10.75 percent applies only to income over $1 million, most District residents pay a lower top rate and even millionaires pay lower rates on their first $1 million of earnings. At the bottom of the income scale, substantial refundable credits provide low-income taxpayers with sizeable tax rebates (though not enough to fully offset all the sales, excise, and property taxes they pay). Relatively few tax carveouts are offered to families at the top of the income scale.

West Virginia’s personal income tax, by contrast, has a narrower range of rates (from 2.36 to 5.12 percent) and a top rate that begins at just $60,000 of taxable income. The state offers relatively little in the way of tax credits for lower-income families but also does not provide particularly generous carveouts to families at the top of the income scale.

Pennsylvania is an example of an income tax structure that does little to improve the state’s tax progressivity. The Keystone State has a flat statutory income tax rate of 3.07 percent, offers no deductions or personal exemptions to reduce taxable income, and does not provide refundable tax credits (the state does offer a tax forgiveness credit that reduces taxes for the very lowest income taxpayers). Pennsylvania’s local income taxes often apply only to wage income, meaning that the capital gains and business income that flow disproportionately to high-income families are often tax exempt. Retirement income is also exempt in Pennsylvania.

While all the taxes presented in Figure 8 are income taxes, their impacts are starkly different across the income scale. D.C. has the highest income tax rates at the top among these three jurisdictions but also the lowest (often negative) income tax rates at the bottom. The slope of its tax across income groups is more steeply progressive than the others.

Pennsylvania, by contrast, levies substantially higher tax rates at the bottom than D.C. and substantially lower rates at the top. Pennsylvania also taxes middle-income families at higher rates than high-income families—a fact owing primarily to the exemption of capital gains and business income from many local income tax bases. In sum, Pennsylvania’s overall income tax system is progressive through roughly the bottom half of the income scale and regressive through the top half.

West Virginia falls somewhere between these two examples, with an income tax that is consistently, but just barely, progressive throughout the entire income distribution. Of these three systems, West Virginia’s come closest to resembling the national average. The very moderate amount of progressivity embedded in West Virginia’s income tax code, and those of many other states, cannot offset the highly regressive impact of sales, excise, and property taxes. The result is an overall tax system that tilts in a regressive direction.

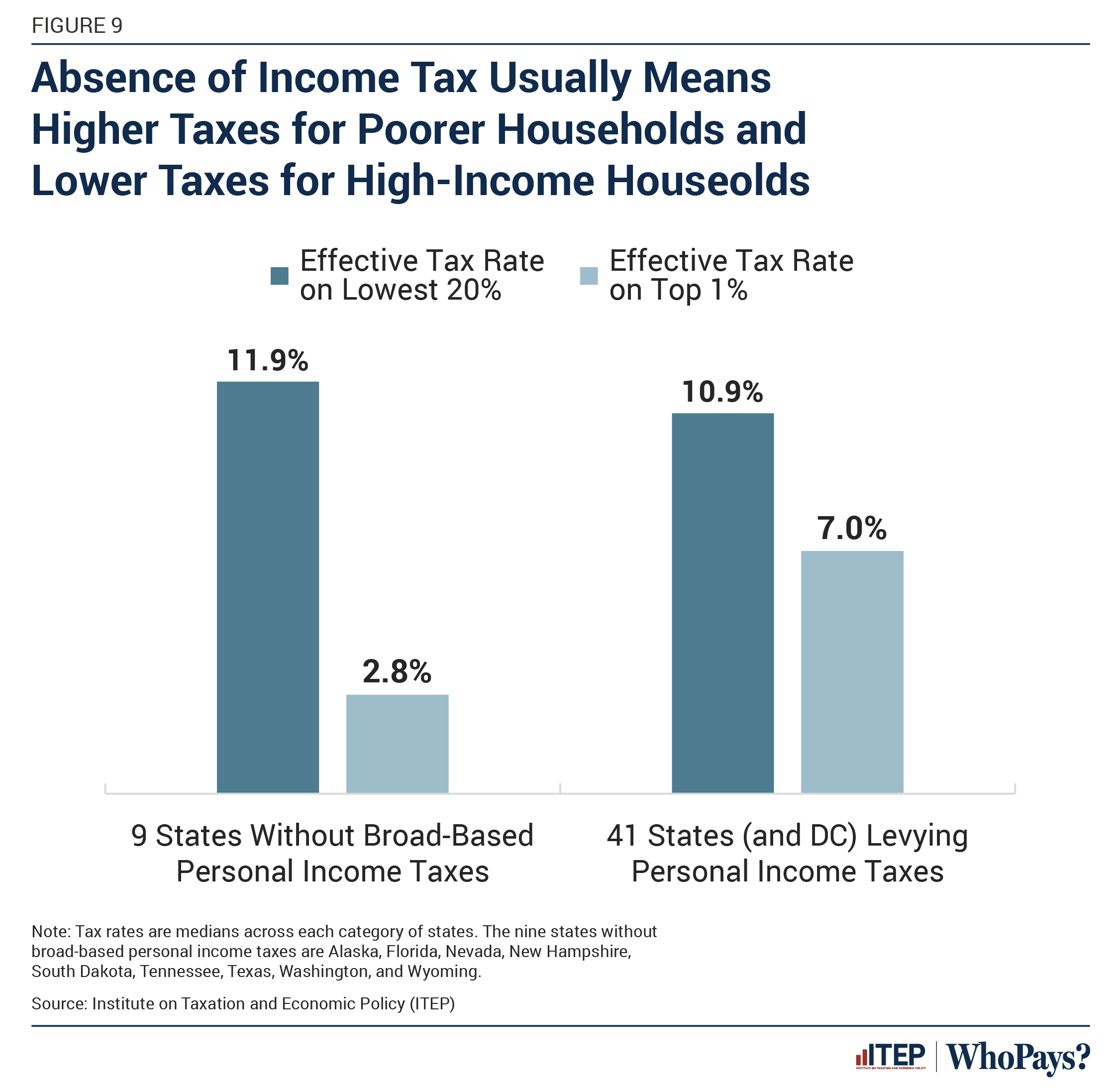

States without Personal Income Taxes

Not levying a personal income tax requires tradeoffs that are detrimental to achieving a progressive tax structure. It is a common misconception that states without personal income taxes are “low tax.” In reality, to compensate for lack of income tax revenues these state governments often rely more heavily on sales and excise taxes that disproportionately impact lower-income families. As a result, while the nine states without broad-based personal income taxes are universally “low tax” for households earning large incomes, these states are usually higher tax for the poor.

Corporate Income Taxes

State corporate income taxes strengthen both the equity and revenue yield of state tax codes. A robust corporate income tax ensures that profitable corporations that benefit from a state’s education system (to provide a trained workforce), transportation system (to move their products), and court and legal systems (to protect their property and business transactions) pay towards the maintenance of those services, just as working people do.

State corporate taxes fall primarily on corporate shareholders, a group that is wealthier than average, disproportionately white, and geographically dispersed. Because of this, robust taxation of corporate profits is an effective means both for lowering inequality and for “exporting” some state tax liability to nonresident taxpayers. Shareholders who live in other states and countries benefit when states provide robust services that bolster the profitability of the companies in which they invest, and corporate taxation ensures that those shareholders help fund those services.

Far too often, however, states struggle to enforce their corporate tax laws as companies move their profits, on paper, to entities that appear to be outside the reach of state taxing authorities. These complex and sometimes legally dubious arrangements are difficult, and time consuming, for state auditors to uncover and contest. To deal with this, most (28) states now use some version of a “combined reporting” system that is less vulnerable to these maneuvers.[22] The most comprehensive and enforceable version of this reform is known as worldwide combined reporting (WWCR), or complete reporting. While no state mandates WWCR comprehensively for all companies, 14 states and the District of Columbia have the building blocks for this reform in place with laws that either allow, or require, companies to file returns that include at least some profits booked in foreign countries, including those classified as tax havens.[23] Another 14 states require combined reporting for profits that companies say are domestic, but exclude profits booked overseas, including in tax haven countries.

Tax Levels and the Use of State Revenues

This study focuses on the distribution of state and local taxes across income levels within each state so that lawmakers and the public can decide whether the tax laws are living up to their vision of fairness. Another key consideration in crafting tax policy is the overall tax and revenue level across states, and variations in the breadth and quality of public services that states provide with differing levels of revenue. While payment of state and local taxes certainly affects families’ economic wellbeing, so too does the quality of K-12 education, health care, infrastructure, higher education, and the strength of the safety net and other services available in each state.

Using the data contained in this report, we find progressive taxation is positively correlated with higher overall tax revenue levels, measured relative to the size of each state’s economy. In other words, upside-down tax codes tend to yield less revenue than tax codes that come closer to being progressive or flat throughout the income scale. This makes intuitive sense. Because high-income families receive such a large share of overall income, choosing to tax them at substantially lower rates than other families will constrain revenue collections in a significant way and leave states and localities with fewer resources to fund schools, infrastructure, and other services.

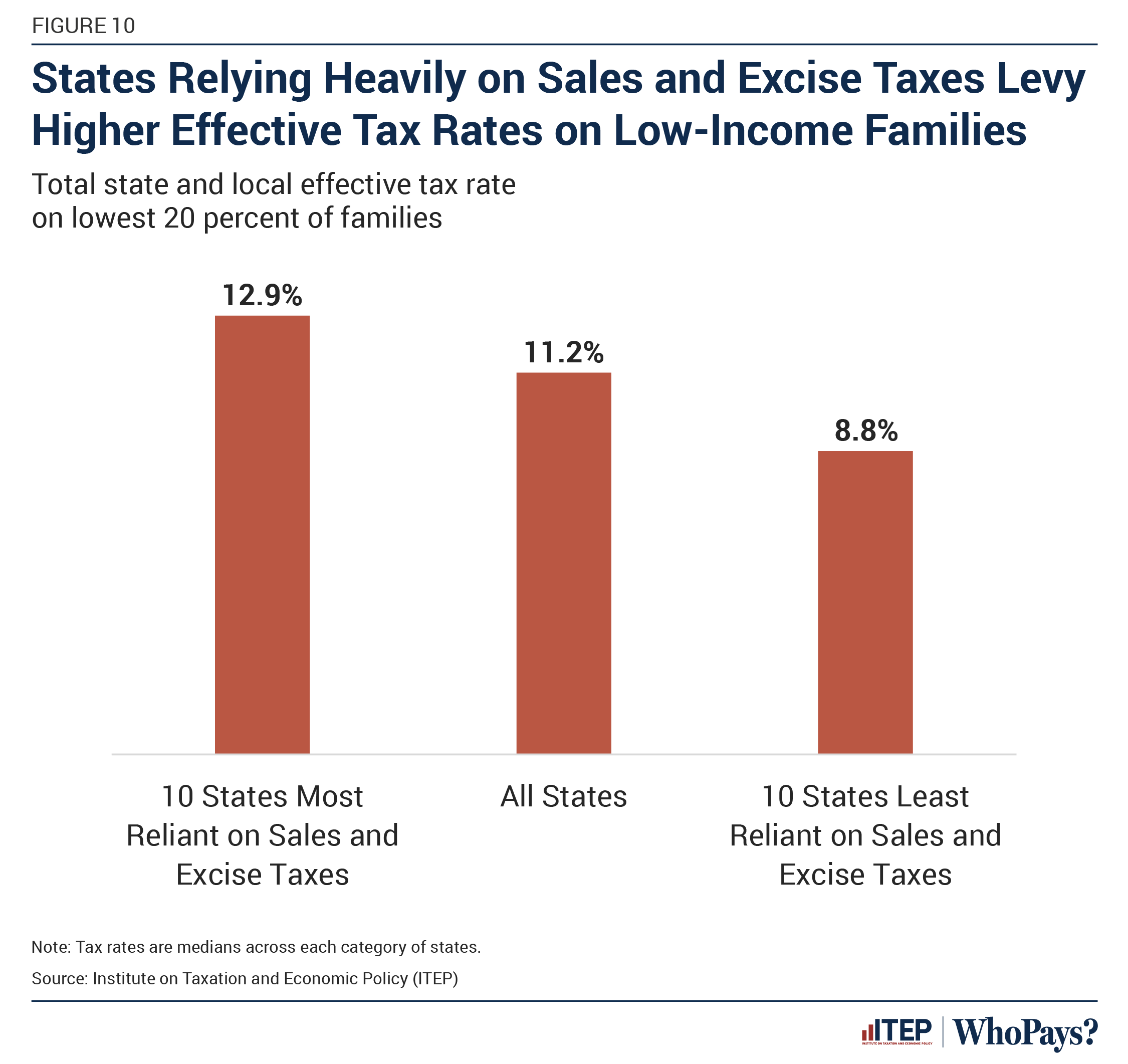

Sales and Excise Taxes

Consumption taxes such as sales and excise taxes are the most regressive elements in most state and local tax systems and the most significant drivers of income and racial inequity in those systems.[24] These taxes apply to spending either broadly (sales and gross receipts taxes) or narrowly (excise taxes).

Sales Taxes

Sales taxes inevitably require a larger share of income from low- and middle-income families than from wealthier families because sales taxes are levied at a flat rate and spending as a share of income falls as income rises. Thus, while a flat rate general sales tax may appear on its face to be neither progressive nor regressive, that is not its practical impact. Unlike an income tax, which generally applies to most income, the sales tax applies only to spent income and exempts saved income. Since high earners can save a much larger share of their incomes than middle-income families—and since the poor can rarely save at all—the tax is inherently regressive.

The average state’s consumption tax structure ends up being like an income tax with a 7 percent rate for the poor, a 4.8 percent rate for the middle class, and a 1 percent rate for the wealthiest taxpayers. Few policymakers would intentionally design an income tax that looks like this, but many have done so by relying heavily on consumption taxes as a revenue source.

On average, sales and excise taxes accounted for more than a third of the state and local taxes collected in 2023. States that rely more heavily on consumption taxes increase the regressivity of their state and local tax systems. Arizona, Arkansas, Florida, Louisiana, Nevada, South Dakota, Tennessee, and Washington raise more than half their tax revenue through regressive sales, excise, and other consumption taxes. All but one of these states are among the 10 most regressive state and local tax systems in the nation (Arizona, the 13th most regressive system, is the only exception).

Which items are included in the sales tax base is another important factor affecting this tax’s regressivity. For example, taxing groceries is a particularly regressive policy because poor families spend a substantial share of their income on groceries. While the federally mandated tax exemption for groceries purchased with Supplemental Nutrition Assistance Program (SNAP) benefits, formerly known as food stamps, helps lessen the impact of these taxes, the effect of this exemp tion is lower than is sometimes claimed. Most grocery spending by families in poverty is done with cash, not SNAP, as less than half of families in poverty participate in SNAP and even those who do participate pay cash for a meaningful share of their grocery purchases.[25]

Four of the 10 states relying most heavily on consumption taxes include groceries in their sales tax bases. South Dakota taxes groceries in full without offsetting relief while Arkansas and Tennessee tax groceries at a reduced rate. Hawaiʻi taxes groceries at the full rate but with a partially offsetting credit for taxpayers making less than $60,000. Seven of the 10 states that we identify as having the highest overall consumption tax rates for the bottom fifth of earners tax groceries at the state level, local level, or both. Those states are Arkansas, Louisiana, Tennessee, Hawaiʻi, Mississippi, Oklahoma, and Illinois.[26]

Excise and Selective Sales Taxes

While general sales taxes are applied to a broad base of taxable items, states and localities also impose narrower taxes on specific types of goods and services.

Some of these levies are aimed at tourists and other visitors, such as taxes on hotel stays and car rentals. These taxes tend to have relatively little effect on lawmakers’ own constituents. Levies on event admissions and restaurant meals can serve a similar purpose, though a larger share of these taxes is paid by residents and they typically have regressive effects.

Other significant taxes in this category include those applied to utility bills and insurance premiums. Both these tax types tend to ask more of low- and middle-income families as they devote a larger share of their earnings toward paying for utilities and insurance than high-income families.

Excise taxes on gasoline and tobacco are familiar examples of selective excise taxes. These levies tend to be particularly regressive because their tax bases have practical per-person maximums (for example, one can only use so much gasoline). But each tax also has policy advantages. Gas taxes require long-distance commuters and owners of heavy vehicles to pay more toward their higher levels of wear and tear on the roads, while tobacco taxes have been shown to be effective in discouraging new smokers.

The key to crafting a state tax system that does not tilt in a regressive direction is not avoiding every form of regressive taxation. Rather, it is ensuring that such levies are not an outsized share of total revenues, and that their regressive effects are counterbalanced by progressive policies elsewhere in the tax code.

Property Taxes

Property taxes are an important revenue source, especially for local governments. Today, a state’s property tax base typically includes only a subset of total wealth: primarily homes and business real estate and, in some states, cars and business property other than real estate. Wealth in the form of business equity, stocks, bonds, patents, copyrights, savings, and other “intangible” property is not generally taxed by any level of government.

Our analysis shows that, overall, the property tax is a regressive tax — albeit far less regressive than sales and excise taxes. There are several reasons for this:

- For homeowners, home values as a share of income tend to decline at higher incomes. A typical middle-income family’s home might be worth five times as much as the family’s annual income, while a rich person’s home might be valued at twice his or her annual income or potentially much less. Homes also represent a larger share of total wealth for the middle class, whereas most of the net worth of wealthy families consists of corporate and business equity that tends to be exempt from property tax.

- Inaccuracies in property tax assessments often result in high-value homes being taxed on a fraction of their value compared to low-value homes. One recent study found that the top tenth of all homes are assessed at half the rate of the bottom tenth.[27] Another found that assessment gaps cause Black and Hispanic homeowners to pay 10 to 13 percent more than white homeowners in comparable homes.[28]

- Renters do not escape property taxes. A portion of the property tax on rental property is passed through to renters in the form of higher rent — and these taxes represent a much larger share of income for poor families than for the wealthy. This adds to the regressivity of the property tax.

- Motor vehicles are usually subject to tax, often with flat-rate registration taxes per vehicle but sometimes with more sophisticated levies that take into account the value, age, fuel efficiency, or weight of the vehicle. Value-based car taxes are regressive because vehicle values are low when measured relative to income (or wealth) for high-income families. Flat-rate car taxes are even more regressive.

Property taxes paid by businesses reduce the regressivity of the property tax as they generally fall on owners of capital and to a significant degree are “exported” to residents of other states.

The effect of real estate property taxes across race and ethnicity is nuanced and complex. Vast differences in intergenerational wealth and a long history of racist housing policy have allowed white households to secure homeownership rates far beyond households of color. Those forces, together with white homebuyers’ aversion to living in areas with large nonwhite populations, have also led to significantly higher market values for white-owned homes relative to those owned by people of color. These factors can lead to higher property tax payments and, as a result, better-funded schools in majority-white areas. But renters, a disproportionate share of whom are people of color, also pay the property tax indirectly through their rent payments. Compounding the challenges in property tax payments, housing segregation and assessment discrimination can result in higher tax bills for people of color relative to what white homeowners in similarly valued homes pay.

The regressivity of property taxes is also dependent on other factors within the control of policymakers, such as the use of exemptions, tax credits, and preferential tax rates for homeowners, and on external factors such as housing patterns in the state. The least regressive property taxes currently are those that tend to use the strategies detailed below.

Homestead Exemptions

The most common form of broad-based state property tax relief for homeowners is the homestead exemption, which usually exempts a flat dollar amount or flat percentage of home value from property tax. Some states apply the exemption only to certain types of property tax levies, such as school taxes, while other states apply the exemption to all homeowner property taxes.

Allowing a generous homestead exemption is what sets less regressive property tax systems apart from the most regressive. While several states have increased the value of their homestead exemptions in recent years, many others have allowed the real value of their homestead exemptions to diminish, as increasing home values made fixed-dollar exemptions less valuable.

Low-Income Property Tax Credits

Most states now offer some kind of credit designed to assist low-income taxpayers in paying their property tax bills. The most effective and targeted property tax credits are “circuit breaker” programs made available to low-income homeowners and renters regardless of age. Today, 29 states and the District of Columbia offer some kind of circuit breaker program. Another 16 states offer an income-limited property tax cut. And five states do not offer any kind of income-targeted property tax break at all (Arkansas, Kentucky, Mississippi, South Carolina, and Texas).[29]

Circuit breaker credits take effect when property tax bills exceed a certain percentage of a person’s income. Unfortunately, slightly more than half of states with circuit breaker credits (17 of 30) reduce their impact by targeting them exclusively to seniors. Only seven states offer substantial circuit breakers to all low-income property taxpayers regardless of age or disability. Moreover, more than two-thirds of states with circuit breakers (21 of 30) extend their programs to at least some renters. Tax credits directed toward low- and moderate-income renters are an especially promising option for narrowing racial disparities as an outsized share of this group is comprised of Black, Hispanic, and Indigenous households. In fact, a tax credit targeted to low-income renters will be even more efficient in reaching historically marginalized communities than one made available to all low-income individuals.[30]

Notably, not a single one of the 10 most regressive states has a true low-income circuit breaker available to low-income homeowners and renters of all ages.

Other Taxes

While the vast majority of state and local taxes can be neatly classified as falling on income, consumption, or property, there are a handful of taxes that defy this categorization and are labeled simply as “Other Taxes” in this report.

Most of these levies are license taxes and are required to run a business or engage in a particular type of activity. These generally comprise a very small share of state and local revenue and are of minimal importance to the overall distribution of tax systems.

In some states, however, severance taxes levied on the extraction of oil, gas, minerals, timber, and other resources are a major source of revenue. These taxes tend to fall primarily on firm owners, making them both progressive and a powerful means of raising revenue from residents of other states and countries.

Low Taxes or Just Regressive Taxes?

This report identifies the most regressive state and local tax systems and the policy choices that drive that outcome. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as “low tax” states, often with an emphasis on their lack of an income tax. But this raises the question: “low tax” for whom?

This study finds that very few states achieve low tax rates across the board for all income groups, and those that do usually rely heavily on energy or tourism sectors that cannot realistically be replicated elsewhere. Alaska is the only state that ranks among the bottom 10 lowest-tax states for all seven income groups included in the study. New Hampshire and North Dakota are among the lowest-tax states for six of their seven income groups. Nevada, South Dakota, and Wyoming have low taxes for five of their income groups.

The absence of an income tax, or low overall tax revenue collections, are often used as shorthand for classifying a state as “low tax.” These two measures are, in fact, reliable indicators that taxes will be low for the highest-income earners, but they tell us next to nothing about the tax level being charged to low-income families.

Florida, Tennessee, Texas, and Washington all forgo broad-based personal income taxation and have low taxes on the rich, yet they are among the highest-tax states in the country for poor families. These states are indicative of a broader pattern. Using the data in this report, we find a modest negative correlation between tax rates charged to the lowest and highest income groups. In other words, if a state has low taxes for its highest-income earners, it is more likely to have high taxes for its lowest-income residents.

Similarly, we find that the overall level of tax revenue collected in a state has almost zero correlation with the tax rate charged to that state’s lowest-income families. Put another way, states that collect comparatively little tax revenue tend to levy tax rates on poor families that are roughly on par with those charged in other states. And, as a group, states collecting higher amounts of revenue do not do so with above-average tax rates on the poor.

For high-income families, on the other hand, overall revenues are highly correlated with their own personal tax bills. This suggests that high-income families receive a financial windfall when a state chooses to collect a low level of tax revenue overall, though that windfall comes at the cost of fewer or lower-quality public services.

Figure 11 shows the states levying the highest taxes on poor families. Pennsylvania is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Pennsylvania’s poor families pay 15.1 percent of their income in state and local taxes. Compare that to neighboring New Jersey, where the poor pay 9.0 percent of their incomes in state and local taxes — far less than in Pennsylvania. New Jersey’s more progressive income tax structure, which includes robust tax credits for low-income families, plays a significant role in this outcome.

A Word About Non-Tax Revenue

Who Pays? examines how, and from whom, state and local governments collect tax revenue. Non-tax revenue is largely excluded from the analysis. Non-tax revenue takes many forms and includes fees, fines, service charges, royalties, interest earnings, and any other monies that are collected by a state or local government outside of the tax code.

Many forms of non-tax revenue are collected in a manner that is disconnected from ability to pay. For example, road tolls and public parking are based on the use of a service and are charged at the same rate regardless of one’s income. Court fees and fines can be particularly onerous for low-income and historically marginalized communities, as a growing group of states pursuing reforms to these charges has recognized.[31]

States where the political climate includes strong anti-tax sentiment are more likely to turn to non-tax revenue options to balance the budget. This worsens economic inequality when the non-tax sources being relied upon do not adequately consider families’ ability to pay. See Appendix C for data on the degree to which states rely on non-tax revenue.

Conclusion

The vast majority of state and local tax systems are regressive, asking less of the wealthy than of low- and middle-income families. These systems worsen income inequality by making incomes more unequal after collecting state and local taxes. A heavy reliance on consumption taxes, together with the absence of a meaningfully graduated personal income tax in many states, are key drivers of this outcome. Recent decisions to reduce or flatten income taxes in some states have added to the high level of regressivity seen in many state and local tax codes.

There are also states, however, that have chosen a different path. Six states and the District of Columbia have structured their tax systems to not be regressive overall. These systems actually narrow income gaps between at least some groups through progressive taxation. Many of these six states, along with some others, have taken steps toward lowering tax regressivity in recent years through reforms strengthening state EITCs, CTCs, and other refundable credits, or by taxing top incomes more robustly.

The wide variety of results seen across states in this study proves that regressive state and local taxation is not inevitable. It is a policy choice. It is ultimately up to the public and their elected officials to decide whether they want to continue a status quo where, in most states, the highest-income families face the lowest state and local tax rates.

Appendices

APPENDIX A: Who Pays Summary Data

APPENDIX B: ITEP Tax Inequality Index and Additional Data

APPENDIX C: Composition of State and Local Revenue by Source

APPENDIX D: Lookback Analyses of State Results if Select Changes Had Not Occurred

APPENDIX E: Lookahead Analyses of Select Upcoming Changes to State Tax Law

APPENDIX F: Analyses of Select Proposals to Reduce or Eliminate Personal Income Taxes

APPENDIX G: Methodology and Discussion

Endnotes

[1] The 7th edition of Who Pays?, unless otherwise noted, shows the impact of permanent tax laws on non-senior taxpayers, including the impact of all tax changes enacted through January 1, 2024, at 2023 income levels.

[2] Aditya Aladangady, et al. “Wealth Inequality and the Racial Wealth Gap,” FEDS Notes, October 2021. Chuck Collins, et al. “The Ever-Growing Gap: Without Change, African-American and Latino Families Won’t Match White Wealth for Centuries,” Institute for Policy Studies. August 2016. https://ips-dc.org/report-ever-growing-gap/.

Chuck Collins, et al. “The Ever-Growing Gap: Without Change, African-American and Latino Families Won’t Match White Wealth for Centuries,” Institute for Policy Studies. August 2016. https://ips-dc.org/report-ever-growing-gap/.

Emmanuel Saez and Gabriel Zucman. “The Rise of Income and Wealth Inequality in America: Evidence from Distributional Macroeconomic Accounts,” Journal of Economic Perspectives, Fall 2020. https://www.aeaweb.org/articles?id=10.1257/jep.34.4.3.

Neil Bhutta et al. ”Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances,“ The Federal Reserve FEDS Notes, September 28, 2020. https://www.federalreserve.gov/econres/notes/feds-notes/disparities-in-wealth-by-race-and-ethnicity-in-the-2019-survey-of-consumer-finances-20200928.html.

[3] Gabriel J. Petek, et al. “Income Inequality Weighs on State Tax Revenues,” Standard & Poor’s Rating Services, September 15, 2014. https://www.documentcloud.org/documents/1301747-s-amp-p-income-inequality-weighs-on-state-tax.

[4] Carl Davis, et al. “Taxes and Racial Equity: An Overview of State and Local Policy Impacts,” Institute on Taxation and Economic Policy, March 31, 2021. https://itep.org/taxes-and-racial-equity/.

[5] Ibid 4.

Carl Davis, et al. “State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes,” Institute on Taxation and Economic Policy, October 4, 2021. https://itep.org/state-income-taxes-and-racial-equity/.

Kamolika Das. “Creating Racially and Economically Equitable Tax Policy in the South,” Institute on Taxation and Economic Policy, June 21, 2021. https://itep.org/creating-racially-and-economically-equitable-tax-policy-in-the-south/.

[6] Carl Davis, et al. “State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes,” Institute on Taxation and Economic Policy, October 4, 2021. https://itep.org/state-income-taxes-and-racial-equity/.

[7] Eli Byerly-Duke and Carl Davis. “The Pitfalls of Flat Income Taxes,” Institute on Taxation and Economic Policy, January 17, 2023. https://itep.org/the-pitfalls-of-flat-income-taxes/.

[8] Marco Guzman. “State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms,” Institute on Taxation and Economic Policy, September 25, 2020. https://itep.org/state-taxation-of-capital-gains-the-folly-of-tax-cuts-case-for-proactive-reforms/.

Carl Davis. “State Itemized Deductions: Surveying the Landscape, Exploring Reforms,” Institute on Taxation and Economic Policy, February 5, 2020. https://itep.org/state-itemized-deductions-surveying-the-landscape-exploring-reforms/.

[9] Aidan Davis and Neva Butkus. “Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023,” Institute on Taxation and Economic Policy, September 12, 2023. https://itep.org/boosting-incomes-improving-equity-state-earned-income-tax-credits-in-2023/.

Aidan Davis and Neva Butkus. “States are Boosting Economic Security with Child Tax Credits in 2023,” Institute on Taxation and Economic Policy, September 12, 2023. https://itep.org/states-are-boosting-economic-security-with-child-tax-credits-in-2023/.

[10] Iowa’s graduated income tax is scheduled to move to flat tax in 2026. See ibid 7.

[11] Marco Guzman. “State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms,” Institute on Taxation and Economic Policy, September 25, 2020. https://itep.org/state-taxation-of-capital-gains-the-folly-of-tax-cuts-case-for-proactive-reforms/.

[12] Julie-Anne Cronin, et al. “Tax Expenditures by Race and Hispanic Ethnicity: An Application of the U.S. Treasury Department’s Race and Hispanic Ethnicity Imputation,” U.S. Department of the Treasury Office of Tax Analysis Working Paper 122, January 2023. https://home.treasury.gov/system/files/131/WP-122.pdf.

[13] Carl Davis. “State Itemized Deductions: Surveying the Landscape, Exploring Reforms,” Institute on Taxation and Economic Policy, February 5, 2020. https://itep.org/state-itemized-deductions-surveying-the-landscape-exploring-reforms/.

[14] Carl Davis and Eli Byerly-Duke. “State Income Tax Subsidies for Seniors,” Institute on Taxation and Economic Policy, March 23, 2023. https://itep.org/state-income-tax-subsidies-for-seniors-2023/.

[15] Institute on Taxation and Economic Policy. “Which States Allow Deductions for Federal Income Taxes Paid?,” December 15, 2023. https://itep.org/federal-income-tax-deduction-state-income-tax.

[16] Carl Davis, et al. “State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes,” Institute on Taxation and Economic Policy, October 4, 2021. https://itep.org/state-income-taxes-and-racial-equity/.

[17] Aidan Davis and Neva Butkus. “Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023,” Institute on Taxation and Economic Policy, September 12, 2023. https://itep.org/boosting-incomes-improving-equity-state-earned-income-tax-credits-in-2023/.